The new SalesTax() function is available for you to start using immediately.

Here’s the page for a deeper understanding and guide to Amazon FBA sales tax.

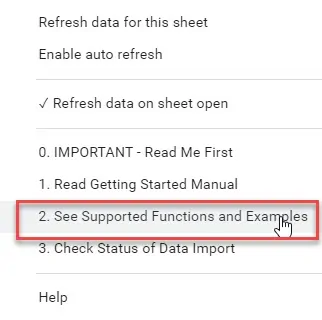

As always, we update documentation consistently and in multiple locations to make it easy to find.

- Official page of all the functions we support

- Google Docs version

- Website version for easier navigation

- On any Google sheet > menu > addons > Gorilla > 2.See Supported Functions and examples

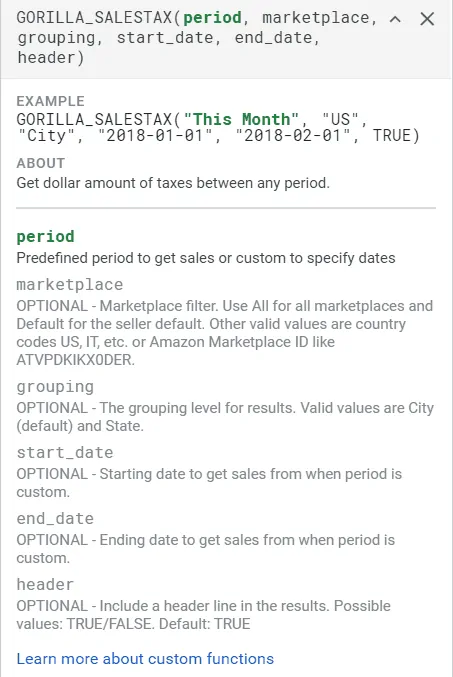

GORILLA_SALESTAX()

Warning: This function is NOT for accounting.

Do NOT use this for your taxes.

Best uses of this function:

- help you prepare how much you will owe

- know which states bring in the most sales

- know which cities bring in the most sales

Easiest example:

=GORILLA_SALESTAX("LAST MONTH")

More examples on the formula functions page under SALESTAX().

If you need to get an idea of how much you owe in taxes, what is being collected by Amazon and what you owe, this function will help you gain a good idea of the amount.

If you need to get an idea of how much you owe in taxes, what is being collected by Amazon and what you owe, this function will help you gain a good idea of the amount.

Again, I can’t stress enough that this is not for accounting purposes. The numbers will be off slightly (+/- 3-7%) because we import transactions daily. If a customer decides to return a product on the 23rd day, Gorilla does not redownload the transactions to reconcile for this refund.

With millions of transactions being processed, it is impossible to redownload everyone’s transactional history.

This is why for taxes, you must export the file directly from Amazon to generate the latest reconciled data.

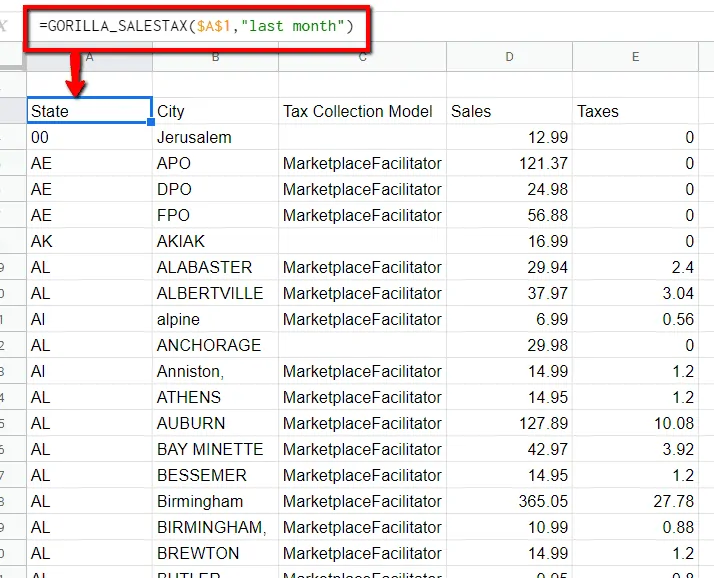

Display Amazon SalesTax by city

The default results will group the sales by city.

It shows the sales of each City as well as the tax amount collected by Amazon or owed by you.

You can also see which city brings in the most sales for you.

This is useful if you want to target ads on Facebook or Google. Targetting towards the city with the most buyers is a good idea to increase conversion and keep ad spend low.

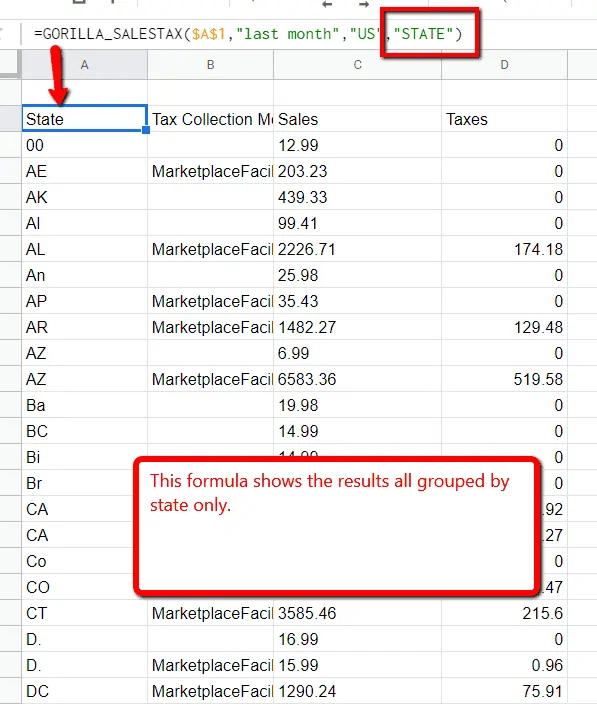

Display SalesTax by state

To group the sales and taxes by state, use the format as in the example below.

=GORILLA_SALESTAX("LAST MONTH", "US", "STATE")

Here’s what it looks like.

If you are registered in multiple states, this will help you organize your cash to figure out how much you can expect to owe.

You can also see where the majority of your buyers are.

Helping with local sales tax remittance

If you file local taxes monthly, you have to enter the cities where you had sales. Trying to do it manually is the worst thing possible.

I literally had to spend hours sorting the reports, combining the data and grouping them by city and state to provide the numbers to the state.

With this function, you can eliminate the majority of the grunt work.

The numbers are not 100% accurate, but they are close enough for you to figure out how much you will owe.

Comments

Related Posts

Mastering Shopify’s UTMs: The Simple Way to Smarter Marketing

Let’s be honest: marketing your Shopify store without tracking what’s…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

Leave a Reply