Article Summary

Risk Coverage Needs: the best eCommerce business insurance helps protect against unique online risks, including product liability, data breaches, and potential damage to inventory.

Cost Factors: Insurance costs vary based on business size, product type, and chosen coverage limits.

Selecting Providers: Companies like Next Insurance, Simply Business, and Thimble are popular for eCommerce coverage, each offering tailored policies for small businesses, online sellers, and Amazon or Etsy vendors.

Running an online store comes with its own set of unique challenges and risks that brick-and-mortar retailers might never face.

From cybersecurity threats to product liability concerns, the best ecommerce business insurance isn’t just a “nice-to-have” – it’s becoming increasingly essential for protecting your digital enterprise.

Understanding the Best Insurance for Ecommerce: A Complete Guide

Picture this: You’re sleeping soundly at night when suddenly, your online store gets hacked, compromising thousands of customer credit card details.

Or perhaps a customer claims your product caused injury, threatening legal action. Without proper ecommerce business insurance, these scenarios could spell disaster for your online venture.

Why Your Online Store Needs Specialized Coverage

Traditional business insurance policies weren’t designed with digital commerce in mind.

The best ecommerce business insurance packages address specific online retail risks while providing comprehensive protection for your digital assets.

Best Insurance Types for Ecommerce Businesses

General Liability Insurance for Ecommerce Business: Your First Line of Defense

Think of general liability insurance as your business’s safety net. It covers:

- Customer injuries from products

- Property damage claims

- Advertising injury (including copyright infringement)

- Legal defense costs

Most ecommerce platforms, including Amazon and Etsy, strongly recommend or require sellers to maintain general liability coverage.

Product Liability Insurance

When selling physical products online, this coverage is non-negotiable. It protects against:

- Claims of injury from product use

- Manufacturing defects

- Design flaws

- Inadequate safety warnings

Cyber Liability Insurance

In today’s digital landscape, cyber liability insurance isn’t optional. It covers:

- Data breach responses

- Customer notification costs

- Legal expenses

- Credit monitoring services for affected customers

- Ransomware attacks

Choosing the Best Ecommerce Business Insurance Provider

Top Insurance Providers for Online Retailers

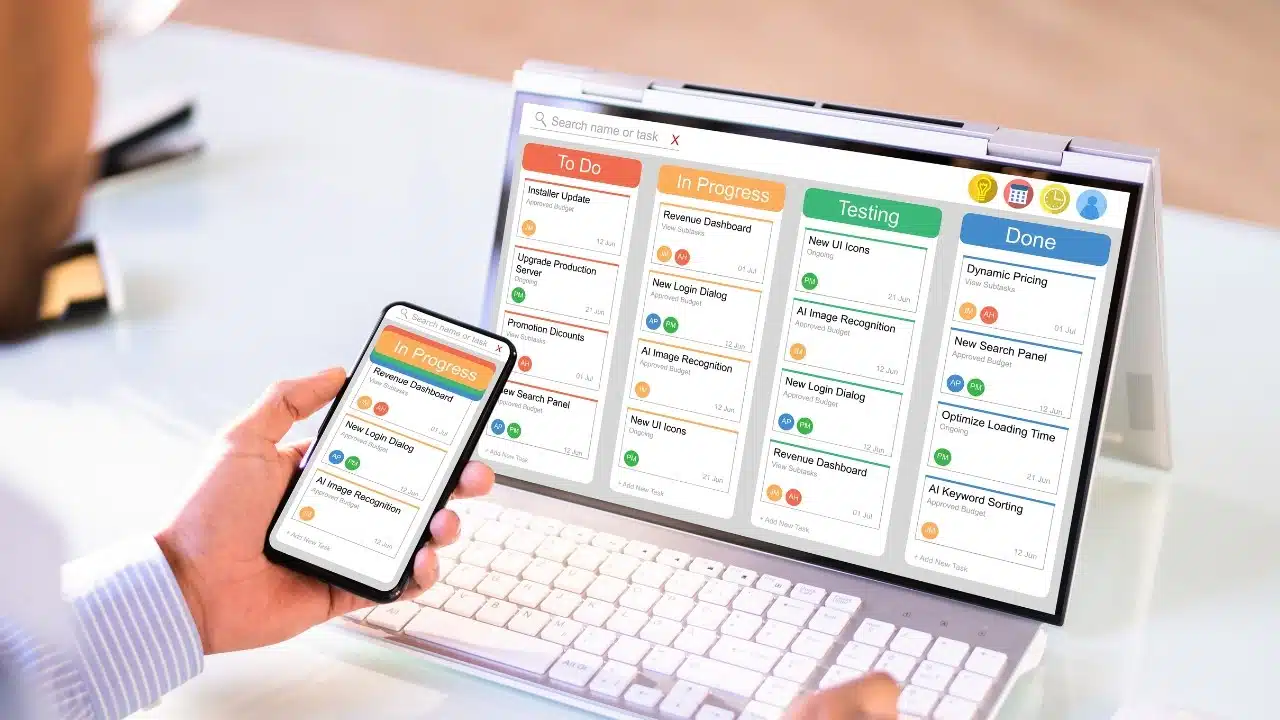

- Specialized ecommerce packages

- Instant online quotes

- Digital certificate management

- Competitive rates for small businesses

- Customizable coverage options

- Multiple carrier quotes

- Excellent customer service

- Perfect for Amazon and Etsy sellers

- Flexible monthly plans

- On-demand coverage

- User-friendly mobile app

- Great for seasonal sellers

Cost Factors That Influence Your Premium

Several factors determine your ecommerce business insurance costs:

- Business Size

- Annual revenue

- Number of employees

- Transaction volume

- Product Type

- Risk level

- Price point

- Storage requirements

- Coverage Limits

- Liability limits

- Deductible amounts

- Additional riders

Frequently Asked Questions About Ecommerce Insurance

Do I Need Insurance if I’m Just Starting My Online Store?

Yes! Even small startups need protection. Consider starting with general liability insurance for ecommerce business operations, then expanding coverage as you grow.

Many providers offer starter packages specifically designed for new online retailers.

What’s the Minimum Coverage I Should Have?

At minimum, experts recommend:

- $1 million in general liability coverage

- Product liability insurance matching your sales volume

- Basic cyber liability protection

Does My Homeowner’s Insurance Cover My Online Business?

No. Most homeowner’s policies explicitly exclude business activities. You’ll need separate ecommerce business insurance to protect your online store properly.

Do You Have a Breakeven Calculator for Amazon Sellers?

Yes, we most certainly do. You can access it here.

Tips for Maximizing Your Insurance Protection

- Regular Policy Reviews

- Assess coverage annually

- Update as your business grows

- Adjust limits based on risk exposure

- Risk Management Practices

- Implement strong security measures

- Document safety procedures

- Keep detailed records

- Bundle Policies When Possible

- Often more cost-effective

- Simplified management

- Better coverage coordination

Making the Right Choice for Your Online Business

Selecting the best insurance for ecommerce isn’t just about finding the lowest premium. Consider:

- Provider Reputation

- Financial stability

- Claims handling history

- Customer reviews

- Coverage Completeness

- Policy exclusions

- Coverage limits

- Additional benefits

- Support Services

- 24/7 claims reporting

- Digital policy management

- Risk assessment tools

The Bottom Line

In today’s digital marketplace, having the right ecommerce business insurance isn’t optional – it’s a fundamental part of your business strategy.

Whether you’re selling handmade crafts on Etsy or running a full-scale online retail operation, protecting your business with comprehensive insurance coverage ensures long-term sustainability and peace of mind.

🗣️ Pro Tip: Remember that the best insurance for ecommerce businesses is one that grows with your company.

Start with essential coverage like general liability insurance for ecommerce business operations, then expand your protection as your online store evolves.

Don’t wait for a crisis to discover gaps in your coverage. Take action now to shield your store with appropriate insurance protection.

Contact multiple providers, compare quotes, and choose a policy that best fits your specific needs and budget.

Additional Resources:

- Small Business Administration Insurance Guide

- National Association of Insurance Commissioners

- Insurance Information Institute – Small Business Insurance Basics

Remember, while insurance might seem like just another business expense, it’s actually an investment in your ecommerce business’s future.

The right coverage can mean the difference between recovering from a setback and closing your digital doors permanently.

Comments

Related Posts

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

Leave a Reply