Article Summary

✅ An explanation to every Amazon seller fee and charge.

✅ Free spreadsheet listing all the seller fees to download.

✅ How to download your Amazon fees and charges to Google sheets.

On this page, you’ll find the ultimate guide to ALL the Amazon seller fees you’ll encounter as a seller.

Note that this guide is not related to FBA estimated fees. Or if you are looking for an FBA calculator, you can download our free calculator.

However, if you are a seller and want to understand the detailed breakdown of every fee and charge that Amazon makes you pay for their services to calculate your cost, profit, and loss, this is the place to be.

Let’s not waste any time.

Difference Between Amazon Seller Fees & Charges

An important and confusing point to first understand is the difference between a fee and a charge.

They are very similar and some items are used interchangeably.

The main difference:

- Amazon seller FEE is when you pay to use a “product” from within the Amazon platform. E.g. a subscription is an FBA software “product” that sellers pay for. Amazon’s warehouse is another product that we pay to use. Fees are considered part of COGS related to selling your product.

- Amazon seller CHARGES are expenses for you to request Amazon to perform a service or task on your behalf. It’s not a product, but more of a service. E.g. gift wrapping is a service you pay for to offer to customers. Removal orders are charges and not fees because you are requesting Amazon to perform a service on your behalf. Charges are considered part of operational expenses and not COGS.

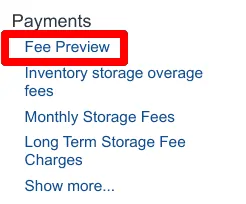

Looking for Fee Preview?

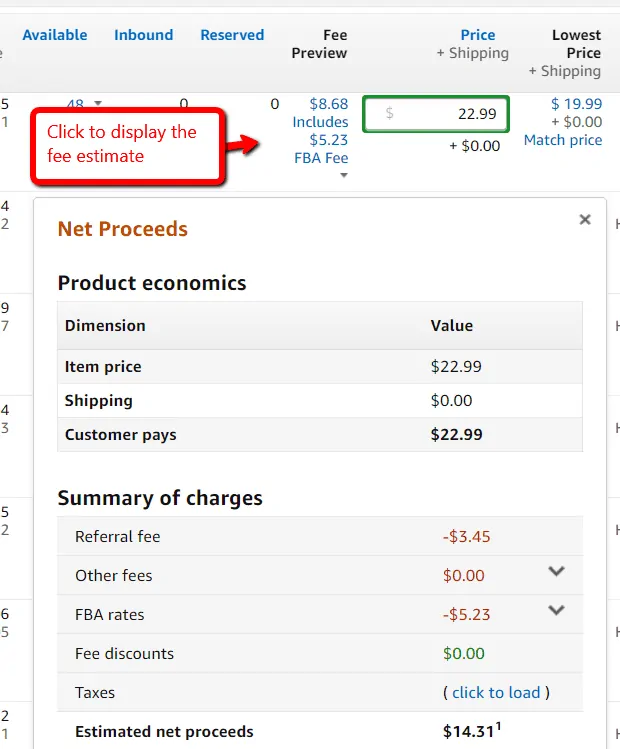

If you want to see a preview of your Amazon seller fees for a product, go to Manage Inventory and then click on the “Fee Preview” link and it will show something like this.

Alternatively, you can check the FBA preview report.

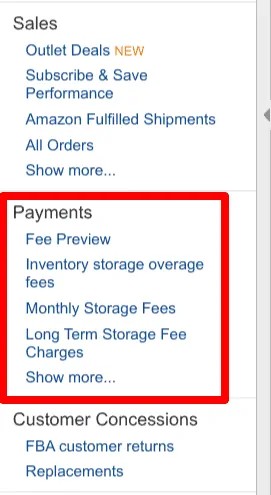

Go to Reports > fulfillment > payments

This will bring you to the reports page. Click on “Fee Preview”.

List of Amazon Seller Fees to Discuss

The following is a list of fees and charges that you will pay Amazon for selling on their platform in alphabetical order.

Amazon Imaging Fee

Amazon has launched an imaging service where the seller can have Amazon pull a product from inventory to take a professional-looking photo.

Prices range from $50 to $150 depending on the type of product.

Amazon Exclusives Fee

Sellers agree to sell their product or products on Amazon exclusively. No other online marketplace except your own website. Physical stores are allowed.

Amazon will give the seller more visibility and perks within the Amazon ecosystem, but if the product is a hit, you are locked into selling via Amazon only.

Also, consider that you will have to pay an additional 5% on all your sales. This includes everything in your inventory that is not listed on Amazon Exclusives. Ouch.

Closing Fees

Also known as variable closing fees and is an extra fee that Amazon adds on top of the referral fee. The rate varies depending on whether it is a media product or a non-media product.

For media products, it is a fixed rate. For non-media products, the variable fee is based on the shipping weight.

Say you sell a book for $20. The referral fee you pay is 15% which is $3.

The variable closing fee is then another fee on top of that depending on your category.

Cash on Delivery Chargeback

Cash on Delivery is no longer used or accepted. An old transactional item for when people did not or did not want to use credit cards online.

Commission

Also known as a referral fee, which is a fee that Amazon charges to all 3rd-party sellers. This is the core fee you need to pay for the privilege of selling on Amazon’s giant platform.

The fee varies greatly with the lowest being 6% for personal computers and 96% for warranties.

If you sell a $1000 PC, then you pay Amazon $60 as a commission.

If you sell a warranty for $100, then you pay Amazon $96.

The most common fee is 15% for most categories.

The fees can change so check the official Amazon list of commission fees here for accuracy and recency.

Coupon Redemption Fee

- Includes Coupon Clip Fee

Amazon charges a fee when you make sell an item that has a coupon attached to it.

When the buyer clips the coupon and makes the purchase you pay $0.60 as a fee for their “coupon service”.

Creating coupons or vouchers is free. However, when it is redeemed, you pay the fee. You do not pay the fee if the buyer only clips the coupon but does not make a purchase.

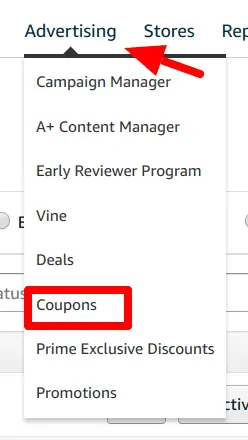

To access the coupon page, click on advertising>coupons

Because of this extra fee, it is important to calculate your margins. This $0.60 fee can make a big difference in how much you are really offering.

You may be thinking you are offering a 5% discount on a $20 product. But after adding $0.60, you are really paying $1.60 for the total coupon.

Your total cost for this coupon is 8%, not 5%.

Cross-Border Fulfillment Fee

If you have activated the option to sell across borders, then Amazon will handle the work related to the export. This could include tax, duties, transportation, and other fees.

The buyer pays for the import duties and the extra in shipping, but for other aspects related to the export based on your settings, you could be paying for the extra process.

Check out Amazon’s page on international order fulfillment.

Downloads Page: Get the Amazon Seller Fees Spreadsheet and More Spreadsheets

Easy Ship Fee

This is the term used for Amazon India.

In the US and other marketplaces, “FBA seller fees” is used as the term. However, Amazon India calls their FBA service as Easy Ship.

ESPO

- EPSO Chargeback fee

- EPSO Cross-Border fee

- EPSO Payment Authorization fee

- EPSO Payment Settle fee

- EPSOChargebackFee

At this time, there is no information available on the definition of ESPO.

This section will be updated when we find out what it means.

FBA Amazon-Partnered Carrier Shipment Fee/Inbound Transportation Charge

- Includes Fresh Inbound Transportation Fee

- Global Inbound Transportation Fee

- FBA Inbound Shipment Carton Level Info Fee

- FBA Inbound Transportation Program Fee

Also known as inbound shipping. The inbound transportation fee is the payment for shipping your products to FBA warehouses using Amazon’s partnered shipping.

Most likely it is through buying the UPS shipping labels when you create a shipment to replenish inventory.

It is also for Amazon’s partner LTL shipments. Anytime you purchase shipping through seller central, the amount is added up in this fee item.

You can use your own carrier and pay them directly, but you can’t beat Amazon’s shipping rate.

Want more advanced Amazon tactics to boost sales?

Be the first to know when a new guide is published and how we are implementing it into our business.

FBA Fulfillment Fees

- Includes FBA Delivery Services Fee

- Includes FBA Weight Based Fee

- Unit Fulfillment Fee

As a seller, this is your biggest expense. It is the fee to cover Amazon’s services to the customer like shipping, refund/returns, and handling sales in their ecosystem.

Check the per-unit fees regularly as it changes yearly.

You can find the amounts paid from your reports section.

Go to Seller central > reports > fulfillment.

You will land on this page with a sidebar for a bunch of information that you can download as CSV files.

A shortcut is to go to manage inventory and the fee preview section.

FBA Inbound

- Includes Fresh Inbound Transportation Fee

- Global Inbound Transportation Fee

- FBA Inbound Shipment Carton Level Info Fee

- FBA Inbound Transportation Program Fee

Inbound refers to the shipment that you send to Amazon. It could be coming from you directly or from your manufacturer.

Amazon requires you to provide accurate information related to your inbound shipment to be processed efficiently. If you enter wrong information about your carton information such as the number of boxes, sizes, and weights, you will pay a fee for the information and work that Amazon has to do to correct it.

This applies to the transportation program fee.

If the amount you paid to UPS or the shipping company is not correct, you will be charged extra for the difference.

Say you entered the box as having a dimension weight of 100kgs or 100lbs.

However, UPS scanners measured it as 120kgs or 120lbs. You will pay the extra fee for the difference.

FBA Inventory Disposals

Amazon FBA has inventory storage fees so it makes sense that they also have inventory disposal fees if you want Amazon to dispose of your inventory.

It’s also called FBA removal order fees.

There are 2 situations to dispose of a product.

- We sell in UK, and if we get a return, there is no point in trying to have it shipped back to us in the US. Therefore, we have selected to “dispose” automatically all returned items.

- You can manually dispose products. If an item does not sell and it’s cheaper to throw away, you can request Amazon to dispose the inventory. If you sell food products and it expires, you can also dispose of it manually.

Here’s the complete list of the different removal fees. Basically, standard size item fees start at $0.15 per item and oversized items are $0.30 per item.

FBA Inventory Removals

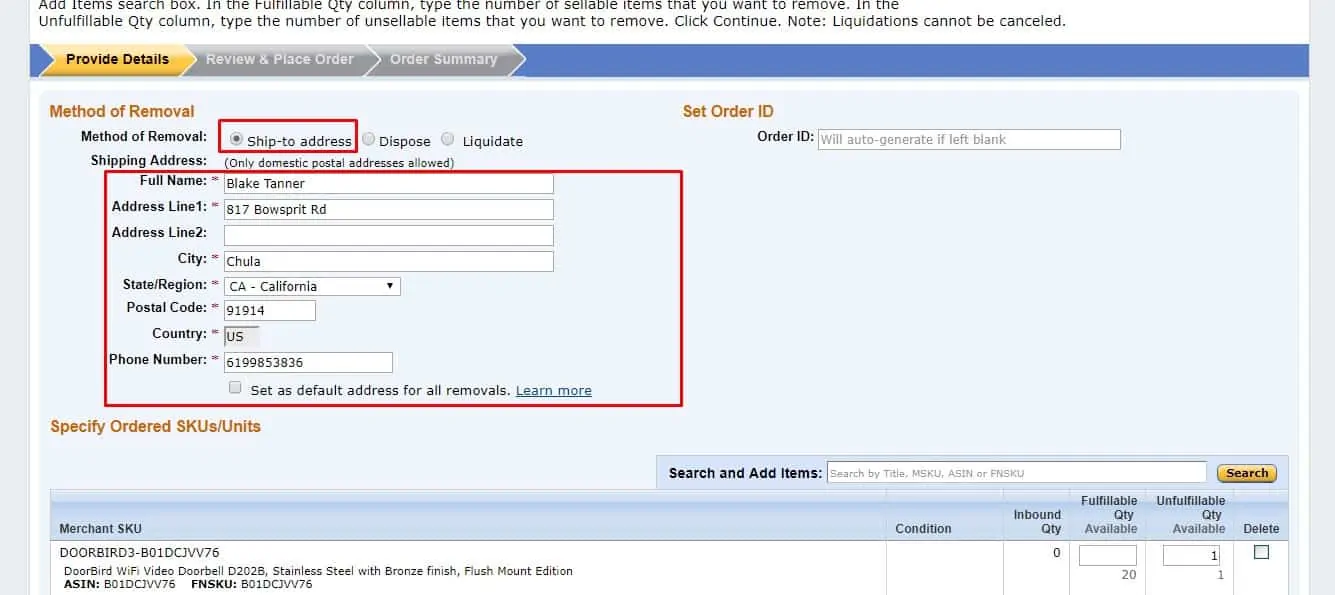

If you don’t want to dispose of the item, you can request to have it sent back to you. Amazon will then recall all the items from their fulfillment centers and ship the items back to you.

FBA Removal fees include disposal (check the link above) and returns.

Removals are more expensive than disposals as Amazon has to pick each item, box it and send it to you.

FBA Inventory Placement Service Fees

When you create a shipment plan to send inventory to Amazon, they will sometimes make you split up your inventory and send it to different fulfillment centers.

This is usually the case when you ship small quantities.

Inventory Placement Service is when you select the option to send your shipment to one destination fulfillment center.

Amazon will then receive it at the FC, split up the quantities and send it to whatever warehouses that need them.

e.g. You are sending 20 cups and the shipment plan says you have to pay for 3 different shipping labels.

One to CA. One to TX. One to NY.

This can be costly.

Or you if you activate the Inventory Placement Fee, you can send everything to a single designated warehouse.

The fees are based on weight. Check the Amazon page for the most up to date and accurate pricing.

Downloads Page: Get the Amazon Seller Fees Spreadsheet and More Spreadsheets

FBA Inventory Storage Fee

Inventory storage fees can eat quickly into your profit if you have slow selling inventory or too much inventory at their warehouses. Amazon does not want you to use their warehouse as stock rooms. Their fulfillment centers must keep turning over inventory.

According to the seller central help page, FBA inventory fee is:

…the daily average volume (measured in cubic feet) for the space your inventory occupies in fulfillment centers.

There are monthly inventory storage fees, monthly inventory storage fees for dangerous goods, and long-term inventory storage fees.

Fees vary by size and peak/off-peak. Check the type of product you have and the volume of the product. Storage fees are charged every 7th and 15th.

Amazon will double the storage fees after one year if your product is still not selling.

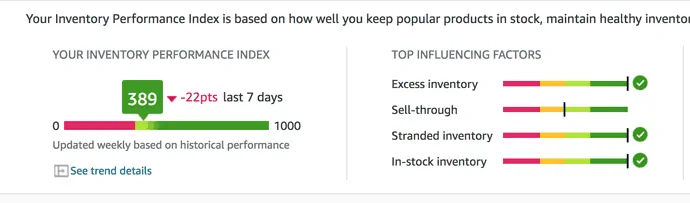

You can track your inventory performance by looking at your Inventory Performance Index.

Inventory removal is a good way to mitigate (or outright avoid) long term storage fees if you think that your products will not sell after 6 months. It simply means taking your inventory out of the Amazon warehouse and shipping it to your own storage facility or your house.

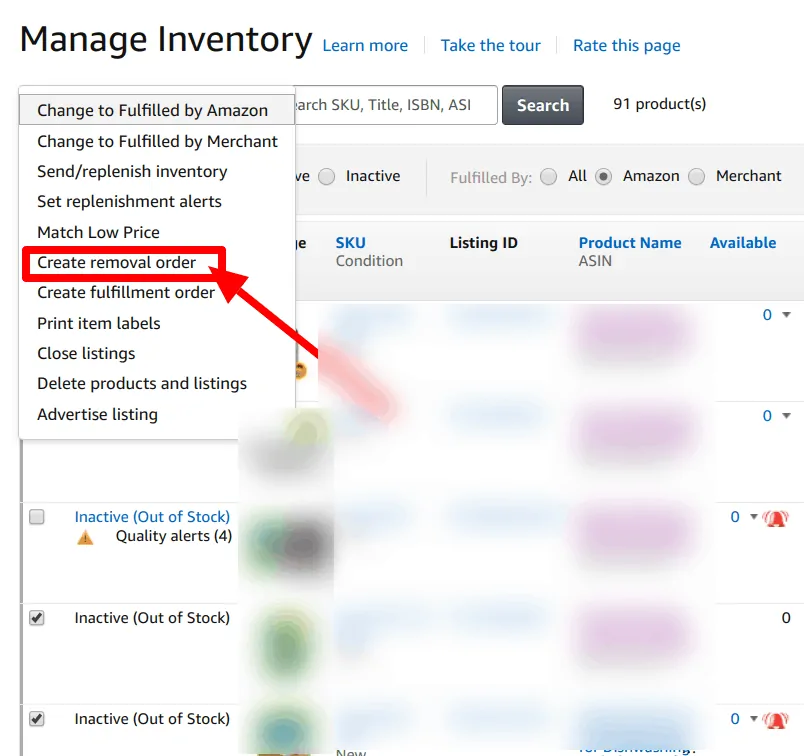

Do this by creating a removal order. Click manage inventory then click the checkbox of the items you wish to be returned. Click the dropdown menu and choose “create removal order”. From there, type in the relevant data, follow the instructions and submit.

FBA Label Service Fee

If you request Amazon to label your products with the ASIN/FNSKU barcodes, Amazon will charge a per labeling fee. The fee per label is $0.20 but check the page for updates in case this fee is increased.

FBA Liquidation Fee

This service is no longer available.

Amazon has gotten rid of the option to allow sellers to liquidate their old (6+months) inventory via 3rd party liquidators.

The only options left are to dispose it or have it sent back to your address.

FBA Long-Term Storage Fees

When your inventory sits in Amazon’s warehouse for 12+ months, it incurs long term storage fees.

Amazon does not want you to use their warehouses like a storage unit. Their fulfillment centers are designed to keep inventory flowing. Anything that is stale inventory is considered wasted space and revenue.

The long-term storage fees change based on the off peak vs peak season.

On the 15th of each month, Fulfillment by Amazon (FBA) conducts an inventory cleanup. On these dates, inventory that has been in US fulfillment centers for more than 365 days incurs a long-term storage fee (LTSF) of $6.90 per cubic foot or a $0.15 per-unit long-term storage fee, whichever is greater.

FBA Multi-Channel Fulfillment Weight Handling

Multi-Channel Fulfillment (MCF) is when you sell your product on a different marketplace like your website, and then you send the order information for Amazon to fulfill.

Depending on the weight of the order, the fees will differ.

For full fee schedules, check out the Multi-Channel Fulfillment costs.

FBA Per Order Fulfillment Fee

This is the old name for Amazon’s FBA Fulfillment Fees.

Previously, Amazon used to separate the fulfillment fees to pick/pack, shipping, weight and so on.

Now it is all rolled into one fee item “FBA Fulfillment Fees”.

FBA Prep Service Fees

- FBA Prep Service Fees (Bubble Wrap)

- FBA Prep Service Fees (Labeling)

- FBA Prep Service Fees-Adult-Bagging (black or opaque)

- FBA Unplanned Prep Service Fees

- Includes Prep Fee refund (PREPFEE_REFUND)

Sellers may need Amazon to handle preparation of the products. It could include bubble wrapping fragile objects, fixing barcode labels or adding extra labels like warning stickers, and repackaging adult products so that it is not visible.

FBA Returns Processing

- FBA Returns Processing Fee-Order Handling

- FBA Returns Processing Fee-Pick & Pack

- FBA Returns Processing Fee-Weight Handling

Additional fees when products are returned by the seller.

FBA Taping Fee

This is part of the FBA Prep section.

Tape

Products with this requirement need additional taping beyond what might normally be used to seal a box or poly bag or secure bubble wrap around an item.

Extra taping may be required if the item:

Might fall out of its packaging if the container is not taped shut

Might leak if the lid is not taped in place

Needs tape to be fully sealed within the container

FBA Transportation Fee

An older name for Inbound Transportation Charge.

This is no longer used but is the amount you pay to ship your items to Amazon via their shipping label service.

FBA Weight Based Fee

This fee is no longer used as it is rolled up into “FBA Fulfillment Fees”.

This was how it was done previously. There are size tiers for different products. Once you’ve determined which size tier your product falls in then you have to pay a flat rate for that product based on shipping weight.

As with the inventory sizes, this is also measured in standard and oversize but the two classifications are also broken down to a few more tiers. You can see the complete chart here, but here’s a quick summary.

Standard products – small standard, large standard

Oversize products – small, medium, large, special oversize

FBA Localization Fee

No information is available from Amazon on the description of this fee.

Our guess is that this is fee is added when Amazon is hired to change the listing language to the local language.

If you live in the USA and want to sell in Japan, Amazon handles the listings and localization of the listing. This looks to be fee-related having it translated and adapted to the Japanese market.

FBA Overage Fee

Your inventory is now measured based on your Inventory Performance Index (IPI). If you have inventory that exceeds the allowed limit based on your IPI, you will pay overage fees.

You could be in the green in terms of storage limits, but if your sell-through drops and you don’t keep track of your performance, your IPI will drop and that will further accelerate your overage fees.

Get Paid Faster Fee

This one is a processing fee for sellers that wish to “get paid faster” from invoiced orders by business buyers. This post sums it up.

We are also launching the ability for you to “Get Paid Faster” for invoiced orders. With this feature, your payment for Pay by Invoice orders will be credited to the available balance of your Selling on Amazon account immediately after shipment for a processing charge of 1.5% of the invoiced order amount. To take advantage of this option, change your invoiced order payment settings to get paid faster for all your future invoiced orders.

With this feature, your payment for Pay by Invoice orders will be credited to the available balance of your Selling on Amazon account immediately after shipment for a processing charge of 1.5% of the invoiced order amount.

This is not worth doing unless you are desperate for cash and can’t wait 30 days to collect the payment from the business buyer.

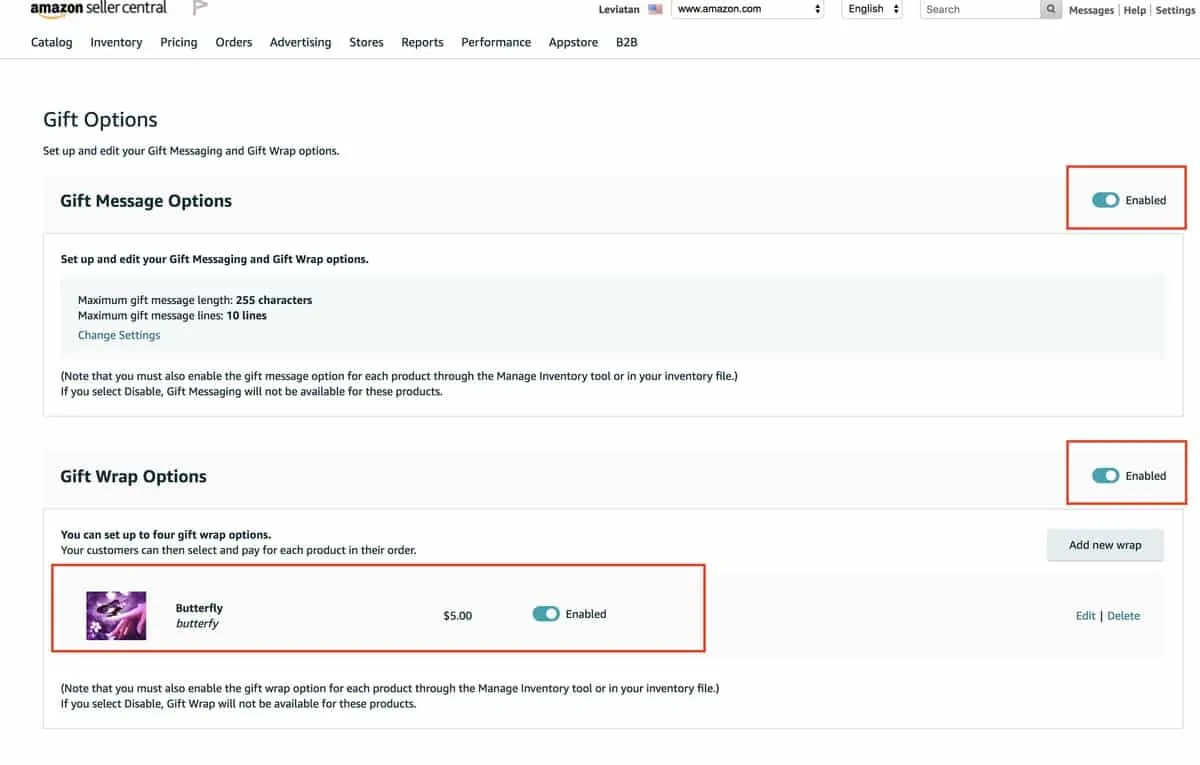

Gift Wrap Commission

This is related to when you collect the gift wrap fee from the customer if you have it enabled on your account.

If you are FBA, Amazon will collect this charge and present it as your revenue. This is your revenue but since Amazon is the party that does the gift wrapping service, they will get a chargeback from you as described in the next section.

Gift Wrap Charge-Back Fee

A shopper selects the gift wrap option at checkout. The shopper pays you for the gift wrap, but since Amazon is the one that gift wraps it, they then do a charge-back to you and this balances it out.

Let’s say Peter buys a $50 glove for Christmas and chooses gift wrap for an extra $5. He pays $55 at checkout and $55 goes into your sales balance.

Amazon will then do the gift wrap and then charge you $5 for the gift wrap.

This way, you end up with $50 for your product.

Gift wrap is optional and not mandatory for FBA sellers.

High-volume Listing Fee

See the pricing information here.

The High-Volume Listing Fee is charged on non-media ASINs for which:

* you have an active offer,

* the ASIN was created more than 12 months ago,

* and the ASIN has not had a sale in the past 12 months.As an allowance, your first 100,000 ASINs that meet these criteria will not be charged the High-Volume Listing Fee.

Jump Start Your Webstore Fee

This is a rare transactional item related to signing up for a service to have Amazon or a 3rd party agency to build your webstore on Amazon.

Amazon has changed the way webstores work, so this transaction is a rare case.

A few years back, sellers could design and upload their own look and format for a storefront. But now it is done through seller central quite easily using the drag and drop interface.

Monthly subscription fee

Amazon FBA accepts two kinds of sellers – individual sellers and professional sellers.

There are hobbyists that sell <= 40 units a month and they can take advantage of the “individual seller” tier which does not have a monthly subscription fee.

For the individual seller accounts, a $1.00 per unit fee is added to every sale on top of all the other FBA fulfillment fees you pay.

Sellers that sell their own products or private label products should use the professional tier. You pay $40/mo to get full access to Amazon’s platform and the extra $1 per unit cost is removed.

Paid Services Fee

No information is available for this fee.

Per-item Fees for Individual Sellers

As mentioned above in the individual seller plan, there’s a $1.00 per unit fee added to each item sold to offset the $40/mo fee you don’t have to pay.

See what they did there?

You are limited to selling 40 units. For each unit sold you pay an extra $1, which equals up to $40/mo.

Individual sellers will only pay Amazon if their items are sold. It’s cheaper for FBA sellers that want to try Amazon or a hobbyist that sells items a few times a month.

But with so much traffic on Amazon, it’s worth paying $40/mo and getting full access to all of their tools for growth.

Purchase of Rented Books

- Includes Rental Extensions

Customers can rent books off Amazon and then purchase it. The fee associated with this is on the fee schedule page.

For each textbook rental that is sold, sellers pay a rental book service fee of USD $5.00.

Sales Tax Collection Fee

Now that Amazon automatically collects sales tax in many of the states, this is becoming less of an issue. But check your transactions to see if there is anything called “SalesTaxCollectionFee”.

Amazon charges 2.9% per order to collect sales tax on your behalf for states where marketplace facilitator is not set up and you have defined it as a nexus in your tax settings.

SSO Fulfillment Fee

There is not enough information about this fee.

Refund Administration Fee

Amazon’s page on refund administration fee.

For media items:

When you issue a full refund for a Books, Music, Video, and DVD (BMVD) product, Amazon will refund all of the original order-related fees.

When you issue a partial refund for a BMVD product, Amazon retains the variable closing fee and credits you a proportional amount of the referral fee originally charged for the order, based on the percentage of the item price you refunded to the buyer.

For non-media items:

When you issue a full refund for a non-BMVD product, Amazon retains 20% of the original order-related-fees, up to a maximum of $5, for each line item in the refund. This amount is retained as a refund administration fee. We will credit you the amount of the order-related fees originally charged for the item you refunded, minus the refund administration fee.

When you issue a partial refund for a non-BMVD product, Amazon retains 20% of the original order-related fees, up to a maximum of $5, for each line item in the refund. Amazon credits you a proportional amount of the referral fee originally charged for the order, based on the percentage of the item price you refunded to the buyer.

If you sell non-media items you lose 20% of the FBA fees for the work they did in shipping it to the customer and processing the returns.

This 20% is called the refund administration fee.

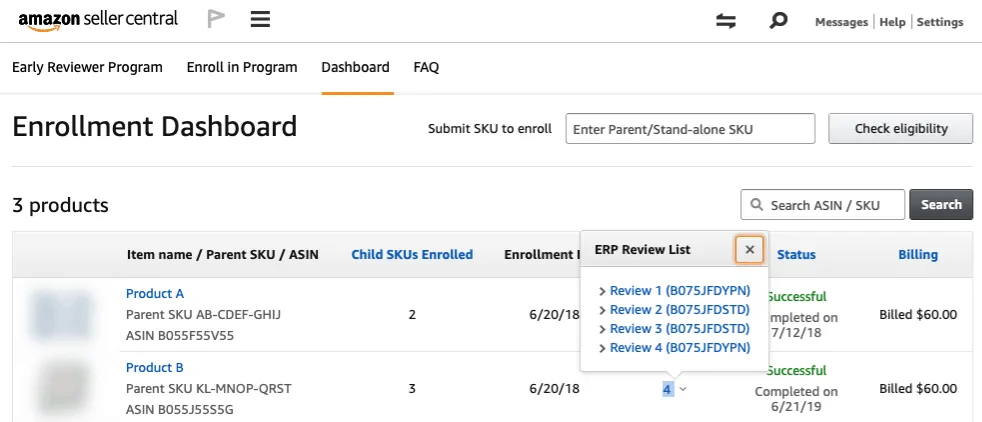

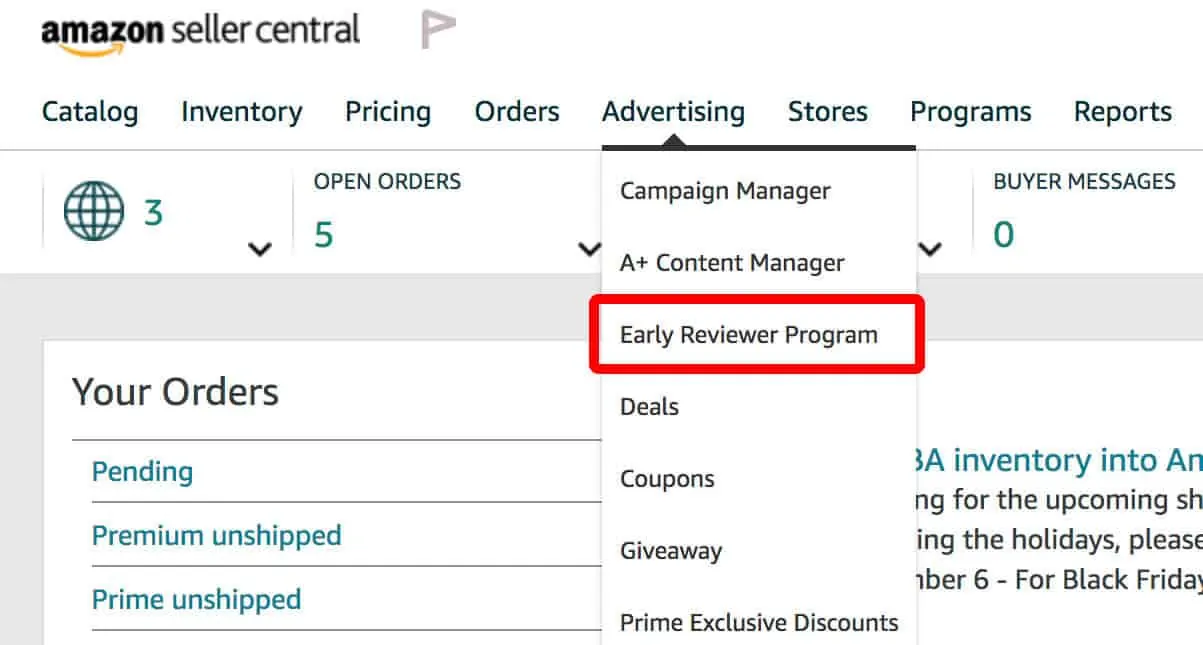

Review Enrollment Fee

Positive reviews are important for the product you’re selling on Amazon.

Having a new product reviewed is a significant leg up for sellers. That’s why Amazon opened up the Amazon Early Reviewer Program.

From seller central go to Advertising > Early reviewer program.

On this page you can submit individual SKUs or use the csv uploader if you want to enroll a list of SKUs.

First thing is to determine if you’re SKU/s are eligible for the early review program.

Here’s how to check.

- Product price should be more than $9.00

- Only choose the parent SKU since child SKUs will be included in the review program automatically.

- Your SKU should have less than 5 reviews on Amazon at the time of enrollment

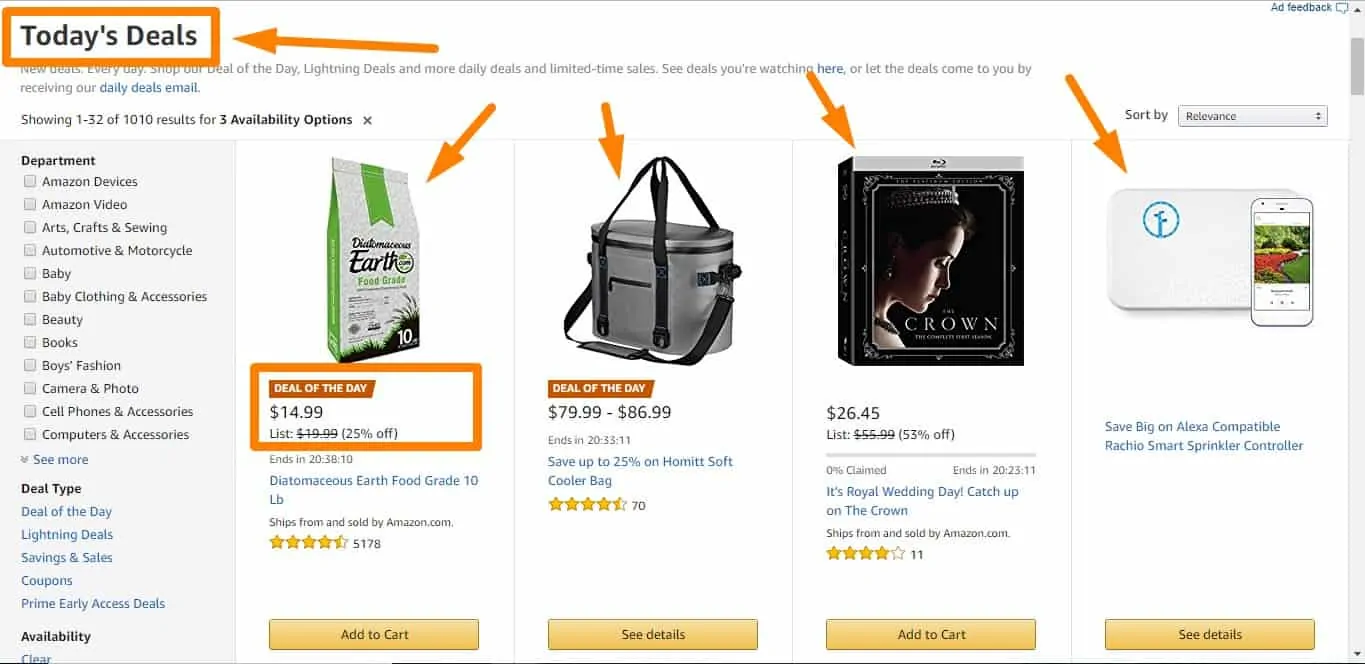

RunLightningDealFee Principal

A Lightning Deal is a promotion offered in a limited quantity for a short period of time.

You can also call it a flash sale, but it is a great way for FBA sellers to have their products posted on the Amazon Todays’s Deals Page.

If you run a lightning deal, you pay $150 for the promotion of your product being featured for a 6 hour period.

Cancellation before the sale period will not require sellers to pay, but sellers will pay in full if they cancel while the sale is still in progress.

A typical fee is $150 but fees are also affected by the country you’re running the deal on and the week your deal will run on. So if you run the deal in a high-traffic country like the USA and you run it during the holidays then you’ll have to pay a higher price.

The week of Black Friday and Cyber Monday costs $300 to host a lightning deal because of such high demand. There is no guarantee you will have a 6-hour window. This window has increased to 12 hours which is more bang for your buck now.

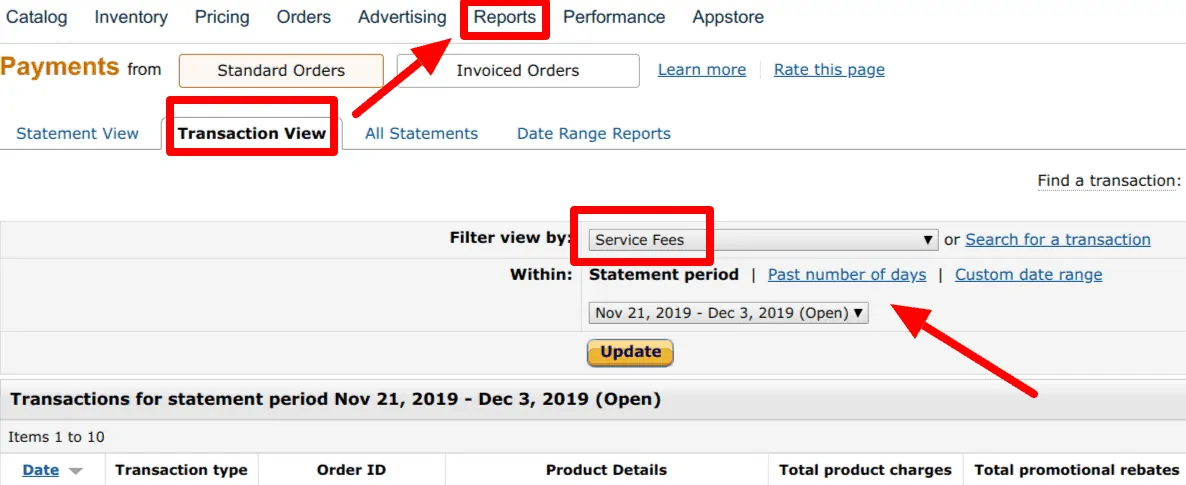

Here’s how to locate the deal fees. In your Amazon seller central dashboard, click on reports, payments, then transaction view.

On this page, you will find “service fees” in the dropdown.

Now if you want to run a lightning deal all you have to do within seller central is click advertising>deals

This will bring you to the deals page where you can create a new deal or check on whatever current and past deals you’ve created.

RunLightningDealFee Tax

This is the taxable amount of the lightning deal fee. If the standard Amazon seller fee is $150 and the tax is 10%, then $15 is on the transaction as going towards taxes.

Since your amount of $150 is final, Amazon receives $135 and Amazon will pay $15 in tax that is collected from your payment.

Like our content? Follow our journey to reach $10M in sales

We share our real failures, wins, and what we are doing on our journey from $0 to $10M in sales.

Shipping Charge-Back Fee

This is the same concept as the Gift Wrap Charge-Back fee.

People who are not Prime members will pay for shipping. At checkout, if they pay $5 in shipping, this $5 goes into your account.

But since Amazon is the one shipping the product, they will take it out of your account with a charge-back to balance out the transaction.

Shipping HB Fee

Also known as Shipping Holdback Fee.

There’s no shipping holdback fee if you do FBA and Amazon is the one shipping your items. But to keep prices down for customers and prevent sellers from taking advantage of Amazon, Amazon implemented the shipping holdback fee.

In the past third-party sellers would list the item for $1 and then charge $29 in shipping in order to avoid paying the referral fee. That’s why this was implemented. A small fee amount is added based on the item if you do 100% discounts because it’s the same concept.

Amazon wants to collect fees for their services, regardless of whether you make money or not. You are using their platform and service and they want to be paid for what they do.

Tax Calculation Services Fees

Taxes should be factored in in any business, but if you don’t want to bother with calculations, Amazon will do it for you. Seller central help define this as:

If you use the tax calculation services, you will pay us (Amazon) 2.9% of all sales and use taxes and other transaction-based charges we calculate. We will retain these fees in the event of any refund on related transactions.

Amazon “Charges” That the Sellers Pay

All the items until now were related to Amazon Seller Fees you pay. Fees and charges are different. Fees are for services that Amazon provides and you want to use.

Amazon Seller Charges are related to the cost of doing business where Amazon will perform an operational task on your behalf and charge you for the work they did.

Amount given to the buyer to compensate for shipping the item back to Amazon

If the buyer is not a Prime member and they required to ship the product back in order to get a refund, Amazon will reimburse the buyer and it will come out of your account.

Charge that Amazon charges the buyer when returning a product

- Includes Compensation for return shipping when a buyer receives the wrong item and requests a free replacement

This is a ledger item with the amount given to the buyer to compensate for shipping the item back.

Let’s say a buyer wants to a return a TV because the wrong item was sent.

Amazon will add the shipping balance to the buyer. The buyer will then use the balance to purchase the return label.

Ultimately, it is a wash for the buyer as they are using the money that Amazon gave them.

Cash on Delivery

- COD charge for an order

- COD charge for an order item

- COD refund

- COD revenue

Cash on delivery is rarely used or accepted.

Compensated Clawback

- Listed as COMPENSATED_CLAWBACK

- A.K.A “reversal”

A “clawback” is a reversal. Also called a reversal reimbursement which is applied to payments that was already reimbursed to the seller. Amazon has paid it to your bank account, but then Amazon takes it back.

Take this example.

We are third-party sellers and I monitor damaged or lost inventory which Amazon will reimburse. But sometimes Amazon finds missing inventory and will reverse the reimbursement.

Compensated clawback could be for:

- fees that was paid back, but then clawed back

- referral fees that was clawed back

- fulfillment fees being clawed back

- reimbursements that was reversed

Customer Return Wrong Item Reimbursement

- Listed as CRETURN_WRONG_ITEM

Buyers are able to return items and then Amazon stores it in their warehouse to restock or resell. This one is a reimbursement given by Amazon if the buyer returns the wrong product and the buyer has been refunded.

For example, if a buyer returns a 2 pack of underwear, but you sell it as a 12 pack set, this will be similar to reimbursement when the buyer doesn’t return the item past 45 days.

Custer Service Error Items Reimbursement

- Listed as CS_ERROR_ITEMS

Sometimes, you will see a $50 refund that Amazon turned into a $150 refund to the customer. This happens a few times and this is an intentional ploy by Amazon customer service to show goodwill to the customer.

Amazon will reimburse you for the difference. Amazon customer service has the power to use your funds to give to the customer as “goodwill” and anything above that is part of this customer service error item.

It’s important to track your finance line items closely to request reimbursement.

DebtPayment

FBA debt happens more frequently than you think.

For example.

When a FBA seller fails to sell anything and they can’t pay the storage fees, the seller has a balance due. If the card on file is not working, it becomes debt and Amazon will seek to get payment on this debt.

Amazon will take this from your account, rather than you having to mail a check or pay via credit card.

Export duty that is charged when Amazon ships an item to an international destination

A general rule is that, unless you’re MCF, sellers don’t pay extra FBA seller fees if they use FBA export to ship internationally.

Buyers pay for international shipping and costs related to export.

There are a couple of things you need to know about FBA export.

- You can exclude countries to sell/export to in your Amazon seller account settings

- Buyers can return products if it is eligible under Amazon’s existing FBA return policy

FBA Liquidation

This option is no longer offered by Amazon. Previously sellers had the option of liquidating old and unsold inventory at liquidation prices. 5-10c on the dollar.

This liquidation service is discontinued.

Fee collected for certain payment methods

No longer used by Amazon.

Free Replacement of Refunded Items Reimbursement

- Listed as FREE_REPLACEMENT_REFUND_ITEMS

Ever return an item and Amazon shows you the option to receive a refund or a replacement?

Amazon will replace the item for your buyer and the buyer has to return the original purchase. In other words, it’s a switch.

If the buyer does not return the original product, Amazon will reimburse you for the product that was not received.

Here’s what Amazon support has to say about it.

Hello from Fulfillment by Amazon,

Getting a replacement for an FBA item just got easier for customers. As of September 5, 2018, a customer returning your item can ask to have a replacement sent to them free of charge – and there will be no cost to you.For you, this means less time focusing on payments and refunds because the sale of the original item is unaffected. For customers, this means more convenient FBA returns, consistent with Amazon returns as a whole.

How it works

To get a replacement item, a customer starts a return through the Online Returns Center or Customer Service.If a customer requests a replacement, Amazon ships one from your inventory and asks the customer to send the original item to one of our returns centers. If they don’t send it back, or if the original item is returned damaged, Amazon will reimburse you according to the FBA customer returns policy.

Other things to know

Only FBA items in new condition qualify for replacement.Only Amazon can offer a replacement item, and only if the item is in your inventory.

You won’t be charged fees or receive payment for replacement orders. Your fees and payment on the original order will stay the same.

For more information on your replacement orders, go to your Replacements report.

Thank you for selling on Amazon.

Sincerely,

The Fulfillment by Amazon team

Generic Bad Debt Deduction

This is a rare transactional item. Bad Debt Deduction is when a buyer purchases your products but does not pay.

Since all Amazon shoppers need a credit card on file, this rarely comes up.

For more info on bad debt deduction, refer to the IRS page.

Gift Wrap Charge

This is the opposite of Gift Wrap Charge-Back Fee, where the customer pays you initially for gift wrapping.

Amazon will collect from you the amount received via the charge-back fee to balance the account.

GoodWill (Amount given to a buyer as a gesture of)

For reasons that Amazon will determine, they will offer a sort of payment to the customer as goodwill.

For example, if Amazon gets a call from an angry customer demanding a replacement AND something extra be done, they could give a $10 credit in addition.

This amount is deducted from your account. Amazon will usually provide this goodwill amount from their own account, but also from the seller’s account.

Inbound Carrier Damage

- Listed as INBOUND_CARRIER_DAMAGE

When your shipments are on an Amazon partnered logistics company and your inbound shipment is damaged during transit, you will get a reimbursement.

It is not a one-to-one reimbursement. You must provide your BOL and other proof of documentation such as insurance to get the proper amount.

Even then, it could still be a battle.

Incorrect Fees Items

- Listed as INCORRECT_FEES_ITEMS

FBA is not 100% accurate. Many times you are over/undercharged.

In the event where you find that your product is wrongly classified into a higher tier and you have been paying more in fees than you should have, Amazon will reimburse you.

Note that until you manually do the work and find the errors, Amazon does not care and will not take any initiative.

There are two types of these- fees items and non-itemized.

Fees items mean there was an incorrect charge for a specific product.

Non-itemized is for non-specific or a service that’s not related to any product or SKU.

Loan Serving

- Loan Advance

- Loan Payment

- Loan Refund

Not a common transaction. If you load goods to products before payment, it would be categorized into the 3 points above.

Lost Or Damaged Reimbursement

If your products are lost or damaged, you will receive a reimbursement if the product has not been found within 30 days.

Amazon determines how much you get back as a reimbursement. It is never the selling price. Amazon will deduct FBA fees and other charges and reimburse the difference.

Low Value Goods

- LowValueGoods-Principal

- LowValueGoods-Shipping

- LowValueGoodsTax-Other

- LowValueGoodsTax-Principal

- LowValueGoodsTax-Shipping

These all fall in the Low Value Goods family of charges and reimbursements.

If If you sell cheap products, the revenue generated is listed under “principal”. “Shipping” is the amount the buyer pays.

For countries like Australia and New Zealand, GST is 15% and will be added on top of the total price, or shipping.

This transaction item will show you the total tax that you have collected. If you do not factor this into your prices, you will end up losing a lot of money as you will be owing money for each low value good that you sell.

Marketplace Facilitator Tax

- MarketplaceFacilitatorTax-Principal

- MarketplaceFacilitatorTax-RestockingFee

- MarketplaceFacilitatorTax-Shipping

Amazon is the marketplace facilitator.

As the marketplace facilitator, Amazon will now be responsible to calculate, collect, remit, and refund state sales tax on sales sold by third party sellers for transactions destined to states where Marketplace Facilitator and/or Marketplace collection legislation is enacted.

These tax items are from Amazon withholding taxes from the sale to pay the due taxes to the states.

Taxes come from the sales amount (principal), whether you charge a restocking fee and if you charge tax on shipping.

Amazon then remits the amounts to the states you are registered in.

Missing From Inbound

- Listed as MISSING_FROM_INBOUND

- Includes Missing From Inbound Clawback (MISSING_FROM_INBOUND_CLAWBACK)

Many times, Amazon will lose your shipment during inbound. Whether it is on the way to a fulfillment center, or during transfer between FC’s.

For units that go missing, you can request to have it investigated and then reimbursed.

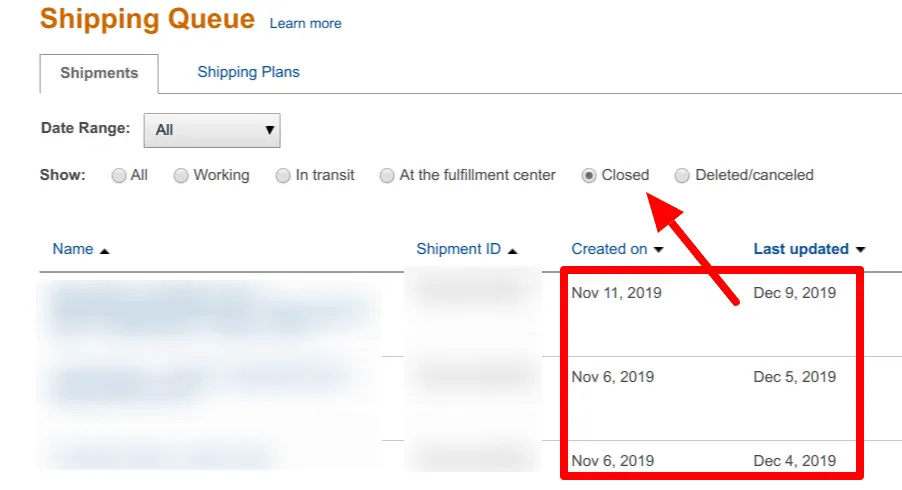

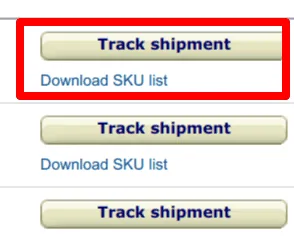

You can see the shipments in seller central when you click on Inventory>Manage FBA Shipments. From here you will see the shipping Queue.

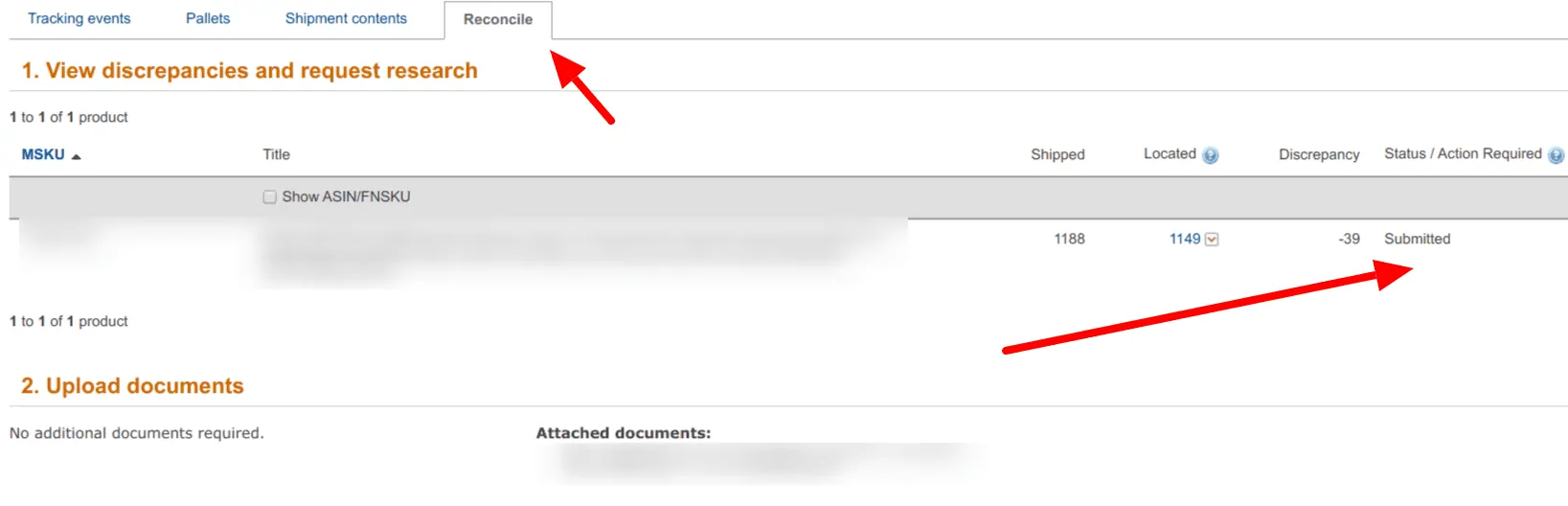

Once on this page, choose the radio button “closed” and you will filter out shipments that are not closed. Look at the number shipped and received.

You can reconcile discrepancies when you ship more than what Amazon received, and Amazon closes it. Even if Amazon closes the shipment, you can still file a manual reconcile.

Click the track shipment button to bring you to the reconcile page.

You need to upload documentation like proof of purchase before you can submit it for investigation.

Missing from inbound clawback is the opposite of missing from inbound reimbursement.

When inventory is misplaced during inbound by Amazon you’ll get a reimbursement for the lost items.

Amazon will claw or take that fee back if they find the inventory they lost.

Multichannel Order

- MULTICHANNEL_ORDER_DAMAGED

- MULTICHANNEL_ORDER_LOST

This is the same as for FBA but it applies to multi channel fulfillment (MCF) where you use Amazon’s logistics system to fulfill orders from other channels like your website.

You will be reimbursed for damaged and lost goods.

Payment Retraction Items

- Listed as PAYMENT_RETRACTION_ITEMS

There is not enough information on this transaction type.

Our guess is that it is related to a reversal of a payment received by the customer. A refund or A-Z claim is processed and comes out of your account.

Product Ads Payment Principal

- Product Ads Payment Principal Charge

- Product Ads Payment Principal Refund

- Product Ads Payment Tax Charge

- Product Ads Payment Tax Refund

As a seller, you can pay for PPC advertising with your credit card or from your balance.

Principal Ads Payment Charge is the amount you will pay Amazon from your account if you choose to pay them with your balance.

The refund is for any discrepancies that needs to be reimbursed to you.

The transaction items that has “Tax” is the taxable amount withheld.

Downloads Page: Get the Amazon Seller Fees Spreadsheet and More Spreadsheets

Promo Rebate

- Includes Promotional discount for an order item

Sellers can choose to offer promos and discounts to buyers as a way to entice people to buy.

This can be in the form of coupons where you offer a fixed price discount or a percentage discount.

Let’s say you have a $10 product and offer a $1 discount. You sell 100 units.

The promo rebate of $100 will be charged to your account.

There are other promo rebates such as free shipping or free super saver shipping to entice shoppers to sign up for Prime membership. Amazon will reimburse you for these types of promos.

Removal Order Damaged

- Listed as REMOVAL_ORDER_DAMAGED

As the name suggests, this is a reimbursement when Amazon damages your items when you request a removal order.

Make sure you have evidence of photos and videos to submit once you receive your items from Amazon. Amazon will never be proactive about it so it is the responsibility of the seller to request reimbursements for damaged items.

Removal Order Lost

- Listed as REMOVAL_ORDER_LOST

If you request a removal order and Amazon loses the item during the process, you will be reimbursed.

However, this is only possible if you count to verify that the amount you requested in the removal order does not match the received amount.

Amazon does not ship all the units in one box. If you request 1,000 units, it will likely come to you in 50 separate boxes as it comes from each fulfillment center that stored the product.

You must wait until you get the “removal order complete” notification via email. Then count the total received and request reimbursement if there is a discrepancy.

Reversal Reimbursement

- REVERSAL_REIMBURSEMENT

This is a general catch-all reversal line item if something does not fit into a specific category.

This is a reimbursement item of the reversals.

SAFE-T Claim

- SAFE-T claim amount for the item

- SAFE-T Reimbursement Charge (listed as SAFETReimbursementCharge)

File a reimbursement (SAFE-T) claim

The Seller Assurance for e-Commerce Transactions (SAFE-T) process allows you to file a claim for reimbursement if you want to appeal Amazon’s decision to issue a refund to a customer. At Amazon’s sole discretion, you may be issued a reimbursement in cases where Amazon determines that you were not at fault.

Selling Price (Principal)

Amazon uses the term “principal” to mean the selling price of the item.

If you sell $20 hot dogs, the principal is $20.

The common term used is sales price, but Amazon uses principal in their terminology.

Shipping Charge

- Includes Shipping charges for a COD order

- Also known as Shipping Income

For buyers who pay shipping, the amount is entered as a shipping charge. Buyers who do not have a prime subscription or existing prime members who pay extra for 1-day shipping pay an extra amount at checkout.

The amount charged for shipping is added to your income as a shipping income.

SI_CRETURN_MERCHANT_REIMBURSEMENT

Not enough information is available for this transaction.

Taxes Collected and Withheld

- Tax amount deducted for promotional rebates

- Tax collected by the seller on a COD Item Charge

- Tax collected by the seller on a COD Order Charge

- Tax collected by the seller on a COD Shipping Charge

- Tax collected by the seller on a Gift wrap charge

- Tax collected by the seller on a Shipping Charge

- Tax withheld by Amazon on other miscellaneous charges

- Tax withheld by Amazon on the Gift-wrap charge

- Tax withheld by Amazon on the Principal

- Tax withheld by Amazon on the Shipping Charge

- Tax Collected at Source for Central Goods and Services Tax

- Tax Collected at Source for Integrated Goods and Services Tax

- Tax Collected at Source for State Goods and Services Tax

- Tax Collected at Source for Union Territories Goods and Services Tax

All the above items are part of the tax collected by the seller.

This is not a charge or a fee.

It is simply the amount of tax that was collected on your behalf by the marketplace facilitator or by you when you sell via FBM. Your tax settings are adjusted based on what you enter into your product listings page.

The most common tax rate setting on a product is A_GEN_TAX.

This code will classify all your products at the general tax rate for your nexus.

With the laws set into place after South Dakota v. Wayfair, businesses without a physical presence in a state with more than 200 transactions or $100,000 in-state sales collect and remit sales taxes on transactions in the state.

Most of this work is now handled by Amazon as it is not possible for small sellers using the Amazon platform to register a business in all 50 states and then submit quarterly or annual tax reports to the states.

The tax is collected for each of the items mentioned above by the marketplace facilitator and they remit the taxes for you.

This is simply a transaction line item showing you how much tax was collected on the sale or service and how much it will be remitted.

When a tax is withheld, it means that the amount has been withheld and not remitted for some reason.

Warehouse Damage

- Listed as WAREHOUSE_DAMAGE

- Includes WAREHOUSE_DAMAGE_EXCEPTION

Amazon will reimburse any warehouse damaged items automatically. You don’t need to issue or file a removal fee in most cases.

Amazon will most likely sell the items at a lower price or dispose of it.

If you find that an item is damaged at the warehouse, you can request an investigation for a reimbursement. When the reimbursement is done manually, it falls into the exception category.

Warehouse Lost

- Listed as WAREHOUSE_LOST

- Includes WAREHOUSE_LOST_MANUAL

The new Amazon policy is Amazon will pay less reimbursement for damaged/lost goods in Amazon warehouse. If you have products that have been lost in their warehouse then Amazon will be the sole arbiter of how much they’re willing to reimburse the seller.

They do have a criteria as basis for the reimbursement. What we know is that one of them is average market price. Other than that Amazon will decide.

As mentioned above, Amazon is not above damaging inventory in their own warehouse or during delivery. I’m not giving Amazon a pass here, but this might be one of the most difficult problems to solve in an operation this huge.

Amazon does make mistakes (many considering how many packages fly around their warehouses) and lose inventory often.

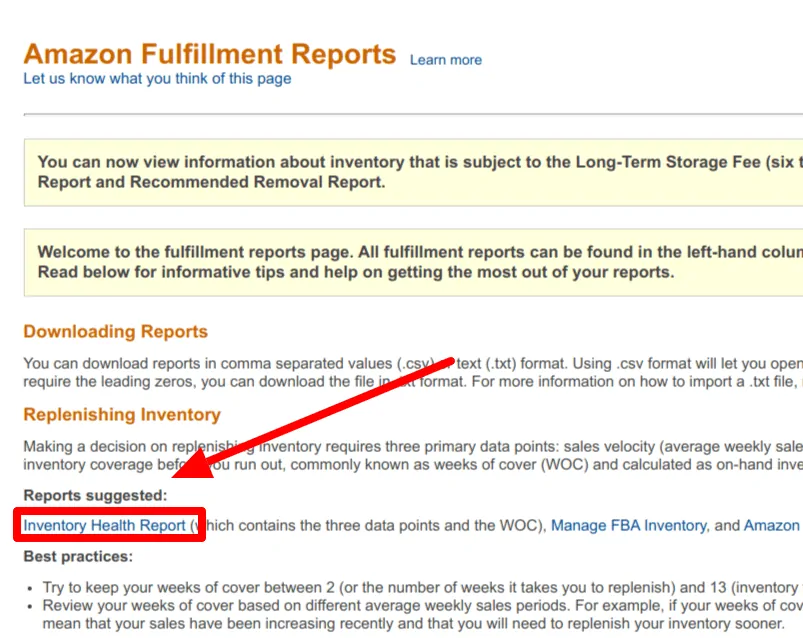

If you know that you have missing inventory past 30 days then you can check the Amazon FBA reports page. If you have no idea, it’s still a good idea to visit that page and click on Inventory Health Report.

Following this page will help you get to the links to help pages and lead you to the reconcile page where you can file a reimbursement request to Amazon.

Free Spreadsheet of Amazon Seller Fees and Charges

Want to see how all of these fees and charges come together to build an Amazon profit and loss spreadsheet?

Downloads Page: Get the Amazon Seller Fees Spreadsheet and More Spreadsheets

Comments

Related Posts

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

3 responses to “Amazon Seller Fees Guide (Examples & FREE Spreadsheet)”

I just love your blog. I really do. I look forward to reading all new entries. I’ve learned a lot from you, Jae.

Maybe you could have a blog entry about how to go about selling ones Amazon business.

Amazon excepted my product and then has decided to reject it because not enough sales so now how do I get my product back from Amazon and do I have to pay any shipping fee

You have to recall the product and pay the fee to get it back.