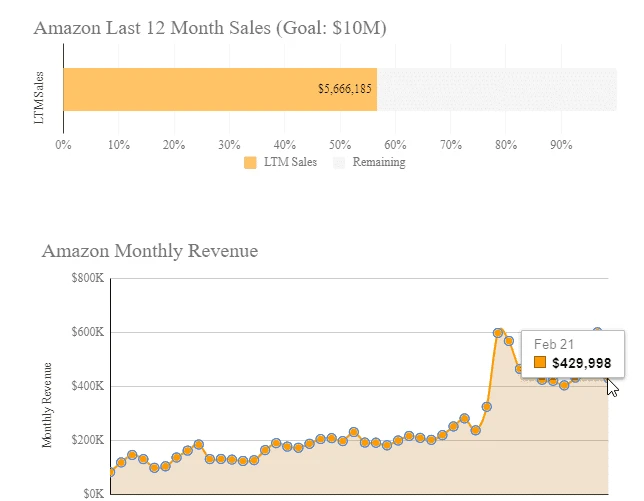

Here’s the current Gorilla ROI Amazon sales progress. To see the interactive version, go to our income reports page.

Note: These monthly updates are for educational purposes only.

Article Summary (TL;DR)

✅ Explore the performance metrics and milestones achieved in February for our FBA business, reaching $430K in sales.

✅ Gain insights into the challenges faced and lessons learned during the month, highlighting opportunities for improvement and future growth.

✅ Learn about the strategies implemented to drive sales growth, including inventory management, pricing optimization, and marketing efforts.

It’s a very different picture compared to the previous month. As I alluded to in January, a lot has happened.

A lot.

Let’s get to it.

- February summary

- Amazon is pushing PPC hard

- #1 seller wiped out and the impact

- What we are doing to get things back on track

- New highly requested Gorilla ROI functions and data

First, the numbers as usual.

February stats

- $430k in sales.

- Up vs last year.

- Down vs last month.

- 81% up from the same month last year

- -28% down from the previous month

- Conversion rate stayed the same at 35%

- ACoS increased to 28.5%.

- TACoS increased to 13.5%.

- Feb Sales to Inventory ratio decreased to 2.24 (higher is better)

- Last month Sales to Inventory ratio was 2.75

You can see a lot of red highlights in the summary.

We are up compared to last year because Feb 2020 was the final month before the Covid boom lifted up sales. March comparisons aren’t looking pretty at this rate.

Expenses have also shot up. PPC continues to increase which is a concern. More sellers are bidding higher to get listed on the front page.

Amazon’s early reviewer program is also ending which means that written reviews are going to be harder to accumulate.

Ratings are easy to submit, and what I’m seeing is that more negative ratings are being posted as the shopper no longer reveals their profile or has to leave a comment.

I’m finding more 4.5 and above rated products are dropping to 4 stars, which reduces conversion and sales.

Amazon’s aggressive PPC direction

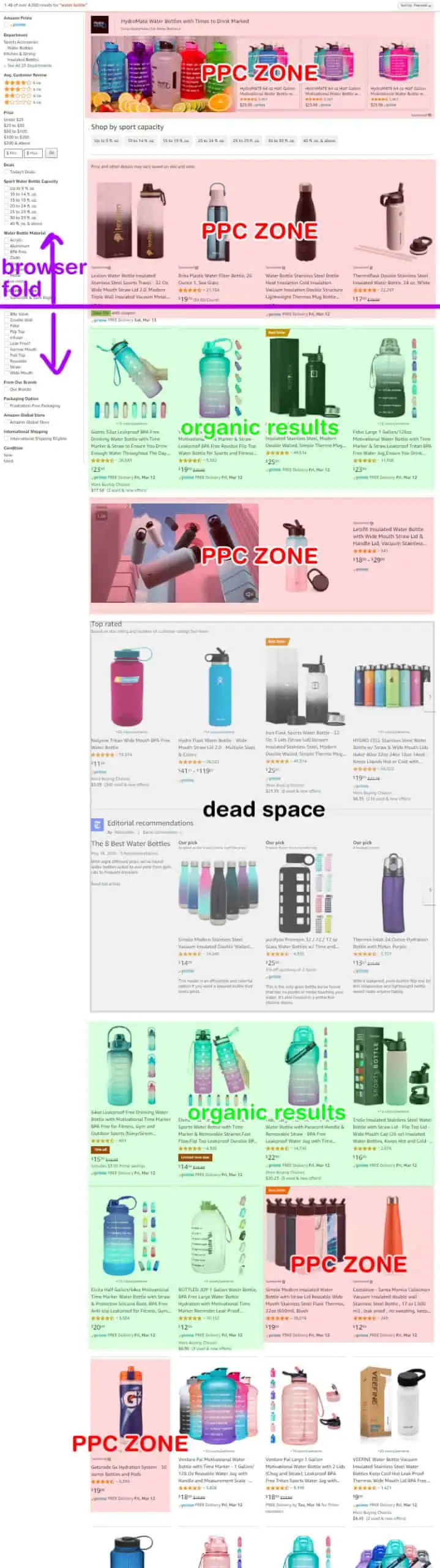

The current PPC landscape looks like this. The purple line is the browser fold.

This is an insanely competitive category and you may be thinking your PPC keywords and niche is safe, but when has Amazon ever gone the other way?

This screenshot is the extreme case now, but it will become the standard OR even the conservative standard within 3 years time. Sooner or later, I won’t be shocked to see 100% sponsored ads for the first two (or three) pages.

This screenshot is not the full page and is supposedly still the first page of results, but there is no way a shopper will make it to the bottom of the page with so many distractions and clickbait ad placements.

I thought Google results ad shoving was bad enough. Amazon puts Google shame with how much they stuff in your face.

- Organic products above the fold is extinct

- Unless you rank 1-4 organically, you will not be visible on the first page for MANY big niches

- Competitive categories display more PPC than ever

- More “dead space” like Top Rated and Editorial Recommendations are being displayed

Looking at this, it’s not a surprise that my ACoS continues to trend up. By selling lower priced products, I have little room for error. On some products, I’m seeing what used to be an ACoS of 20% now in the 30-50% range.

Absolutely bonkers with people bidding up, and having to pay to play. Us included.

If you aren’t ranking organically in the top 4 slots, there’s no way to get visibility other than paying for ads, sponsored brands, videos or editorial reviews.

I’ll leave it here for now as I plan to publish an in-depth look at the state of Amazon PPC.

ugh

Our #1 listing delisted

This is a multi-million dollar product.

Here’s what’s worse.

- ACoS on this product was < 5% because we ranked #1 for mostly every keyword related to the category and product

- It’s a product where we have to suppress sales so as not to go out of stock

- Listing has several thousands of real reviews and customer photos. 100% organic.

- Rated 4.6

- Featured and written about in publications

- Voice of customer shows excellent ratings

Killed by Amazon.

The dreaded “sold used as new” claim. A claim rate of 0.007% or less compared to how many we sell.

Yet Amazon deleted it.

In the past, when the same claim came up, I was able to get it relisted easily by submitting a detailed plan of action, invoices, and other proof. However with the continual rise of Amazon’s BS, this time they are rejecting it each time.

(If you want to get the basic version of my Amazon plan of action template, you can download it from the post.)

I’m thinking up different ways to get the listing reactivated but I’m also reading other big sellers that had the same problem took 6 months or longer to get it reinstated.

When the listing got removed, it hurt. I got angry of course.

But I knew anything could happen doing business on Amazon. What is saving us right now is that our business always thinks about worst-case scenarios and prevention in the event of emergencies or something like this happening.

Everything is great when sales keep rolling in, but if you don’t have a contingency plan, you are screwed.

If you don’t have plans and backups for your products and operations, you need to start now.

Our internal plan of action

The first time it happened 3 or 4 years back, I was panicked. Not going to lie. I realized how vulnerable the business was.

I told myself that if our bread and butter product went down again, I wanted to make sure it wasn’t going to kill us.

There are too many stories of people going out of business because their main product got killed, or they were never able to recover.

Creating a brand or direct website doesn’t work if you sell something common like paper plates. When was the last time you went to a paper plate website and made a purchase?

I wanted a way for our other products to take some of the sales from our number 1 listing.

The idea was to steal or “redirect” sales from the number 1 product into the number 2. In real-life, it’s called cannibalizing, but on Amazon, I call it spreading out the risk and that’s exactly what I wanted.

But my team and I took this mindset further. I shared in our 2019 year end report our plan to create a shotgun approach to listings.

Rather than making just one other listing to take the sale, we started creating more bundles and variations to diversify the sales as much as possible.

Because we run our own warehouse and operations, it’s easy for us to be flexible in this way. We are constantly testing different ways of selling the product with addons, upsells, bundles, variations and more.

We can convert every SKU into at least 10 SKUs with all the bundles and variations that can be created out of it. Having a concentrated product line makes this even easier as we can create many usable and desired combinations.

If I’m selling spoons, rather than just selling a spoon, I create listings that includes a combination of spoons, forks, plates, napkins, cups and so on. Then start playing around with quantities, sizes and it instantly creates a boatload of new SKUs without adding a new product.

If you ship straight to Amazon or to a 3PL, this isn’t possible or gets super expensive. It’s a competitive edge we have over other sellers.

Then we put ads against our own listings to point to our secondary listings. This sounds stupid, but look at the PPC image above again. It’s the same on the listings page. Why let a competitor into your territory? Might as well put an ad yourself and then if it converts, you still capture the sale. I would rather lose 10-20% of a sale than 100%.

This might sound stupid and crazy, but the results speak for themselves.

With my best listings taken down, yes, I’ve currently lost 100% of the sales.

But if I didn’t have any backup listings and didn’t season them for over a year, I’d be bleeding right now without a guarantee that the original listing will be reactivated.

If I try to nurture a new listing, it would take months and easily 5 figures for PPC, giveaways, or whatever.

Because this has been in the works for years, when it finally happened, the other listings took over and grabbed the majority of the sales.

It is not re-capturing 100% of the sale, but even at 70-80%, it is better than 0% while I continue to fight Amazon and look for ways to get it reactivated.

If you don’t have any contingency plans ready for your business – good luck. Amazon can and will rip the rug from under your feet at any time.

Supply chain isn’t going to get better

If you don’t have deep pockets to run ads and withstand the increase in lead times, selling on Amazon is tough.

It’s why I called BS on the “Amazon Automation” fad going around that claim you can make 50-80% returns.

It’s no longer about how to find the best product with a scouting software, or what niche to sell.

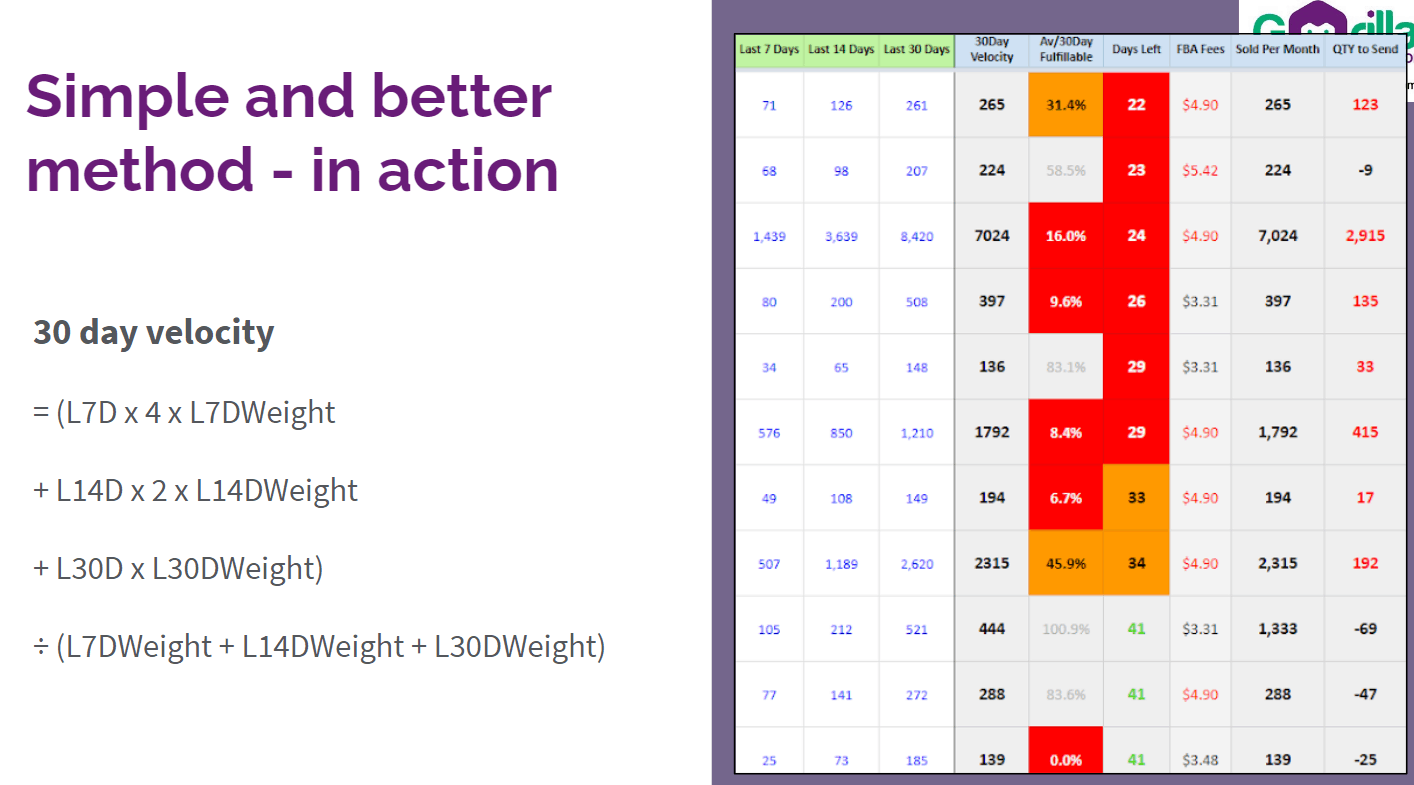

I find myself writing about operations a lot – especially supply chain because it impacts everything. The copy on your listing doesn’t matter if you don’t have product to sell.

Even if your copy sucks, as long as you don’t run out of your best-selling products, you’ll outsell your competition when they run out of stock.

Stay in stock.

Another blow to us is that I messed up on this part. December and January went a little too well and left us scrambling for more inventory. I calculated that I should have enough inventory to last through the Chinese new year, but it still wasn’t enough.

- Now I’m competing with other customers to have our orders manufactured

- Container bookings take 30-45 days longer

- Ships are taking roundabout routes so they can keep offloading and loading containers to make more money which also adds 2-3 weeks of sea time

- Traffic at ports is adding 2 weeks

- Truckers aren’t delivering on time

What used to be a 4 month lead time is now easily a 6-8 month lead time.

I’m stingy with cash and I’m glad I am because for the next year, a lot of cash will always be tied up in inventory as finished goods while it sits on a boat/train/truck somewhere other than in my warehouse or Amazon FC being sold.

Add all the new products we are developing in tandem this year along with all the POs we have to submit. It’s going to be very capital intensive for the foreseeable future.

I don’t see this improving anytime soon.

If you have the cash, I suggest you start ordering 2x the amount of 2x more frequently because it’s only going to get worse. With leadtimes at current levels, you have to put orders in June to get Q4 or 2022 Q1 products.

And then you blink and realize it’s Chinese new year 2022 already.

- Recalculate your leadtimes and analyze every component of it

- Reevaluate your costs because raw materials are going up for everything

- Reevaluate your selling price weekly

- Check your COGS spreadsheets weekly

I wrote a very detailed and lengthy post on Amazon supply chain management and current outlook.

Highly requested Gorilla functions and data

We’ve been busy adding more important data points to make your life easier.

Gorilla ROI users for US marketplace – deadline is March 31

Starting April, our old developer ID will be removed and your data will no longer update.

Only for US (North America) seller accounts. Not for EU or other countries.

Instructions to switch to the new ID if you haven’t done so.

New updates and features

-

NEW: RATINGSCOUNT(). This will give you the count of all the ratings on your listing. Amazon now includes global ratings and also non-written ratings.

-

NEW: INVENTORYRECEIVED(). Get the quantity of skus received in your shipment. Start to automate your reimbursement requests for missing items from shipment.

-

NEW: ISFBA(). User requests. Check whether a SKU or ASIN is FBA, FBM or both.

-

UPDATED: REVIEWCOUNT(). Gives a count of the written reviews only. Not the total number of ratings.

Articles published

- Detailed look at the current state of Amazon supply chain

- I added a free Amazon fee calculator based on weight and longest side. Easier to use than entering lots of useless data into Amazon’s calculator or other versions on the internet.

- The ProfitLoss() for some reason is hard for some people. This one is another detailed guide and I’ve included a free download of an Amazon profit calculator that you can also use as a profit loss template.

More free Amazon FBA spreadsheets for all

We’ve added more templates for both basic users and PRO spreadsheet buyers. More free Amazon spreadsheets are being created too.

You can download it immediately without having to sign up for anything.

Just copy straight to your account.

If you have custom spreadsheets you use in your business already, you can automate it with our Gorilla ROI addon. Tons of flexibility to create the reports that work for your business.

Comments

Related Posts

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

Leave a Reply