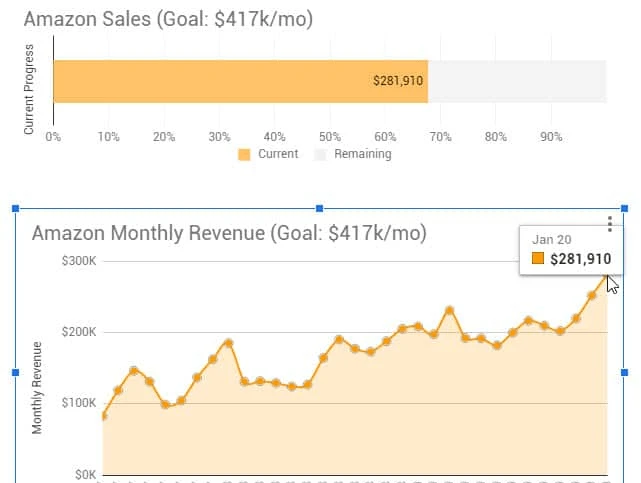

Gorilla ROI Amazon sales progress. To see the interactive version, go to this page.

Note: These monthly updates are for educational purposes.

Article Summary (TL;DR)

✅ Explore the performance metrics and milestones achieved in January for our FBA business, reaching $282K in sales.

✅ Gain insights into the challenges faced and lessons learned during the month, highlighting opportunities for improvement and future growth.

✅ Learn about the strategies implemented to drive sales growth, including inventory management, pricing optimization, and marketing efforts.

I’m stupefied by our January results.

January is usually good to us, but normally it translates to numbers that are in line with December results.

After all, December is a shopping bonanza and the best month of the year. But January was much better than usual.

Here are the stats and my thoughts.

January highlights

- Finished January at $282k in sales

- Margins increased from December as we kept prices steady but also raised prices on our best sellers to try and slow the sales

- New bundles and variations we created boosted our presence even further

- 11% growth from Dec

- 35% growth from last year Jan

- Consistent conversion rate of 20.5%

- Cleaned up and switched accounting from cash to accrual (finally)

- New keyword/content siloing strategy going into effect for new listings

Lowlights for January

- Coronavirus

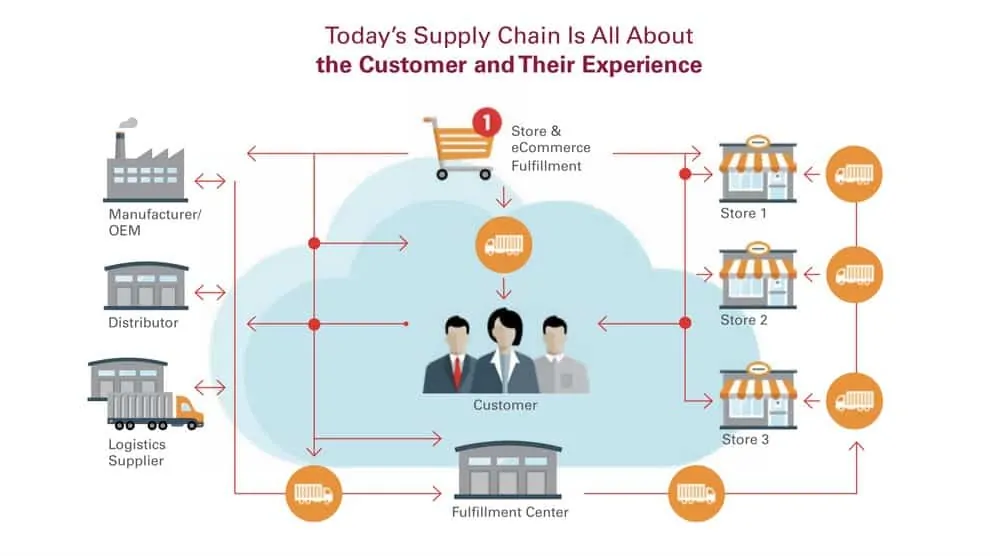

- Sales spikes and supply chain management

- Wasted spend on failed lightning deals

- Port congestion and delays

- Going out of stock

How did January Grow?

Did you read our end of year results and thoughts?

Why are we up 11% from December?

I did lay out some growth plans in the December report, but to say it’s working within a month or implementation is a stretch.

I admit, I don’t know the single reason. And that’s OK because it’s likely a result of multiple factors.

- People usually buy our cleaning products to start the new year

- People received Amazon gift cards for Christmas and want to spend it

- Economy is better than what the news makes it out to be

- Amazon’s recent review count updates where they’ve merged products again and many buyer accounts had their reviews deleted again

These reasons are mostly secondary and a by-product of putting in the groundwork.

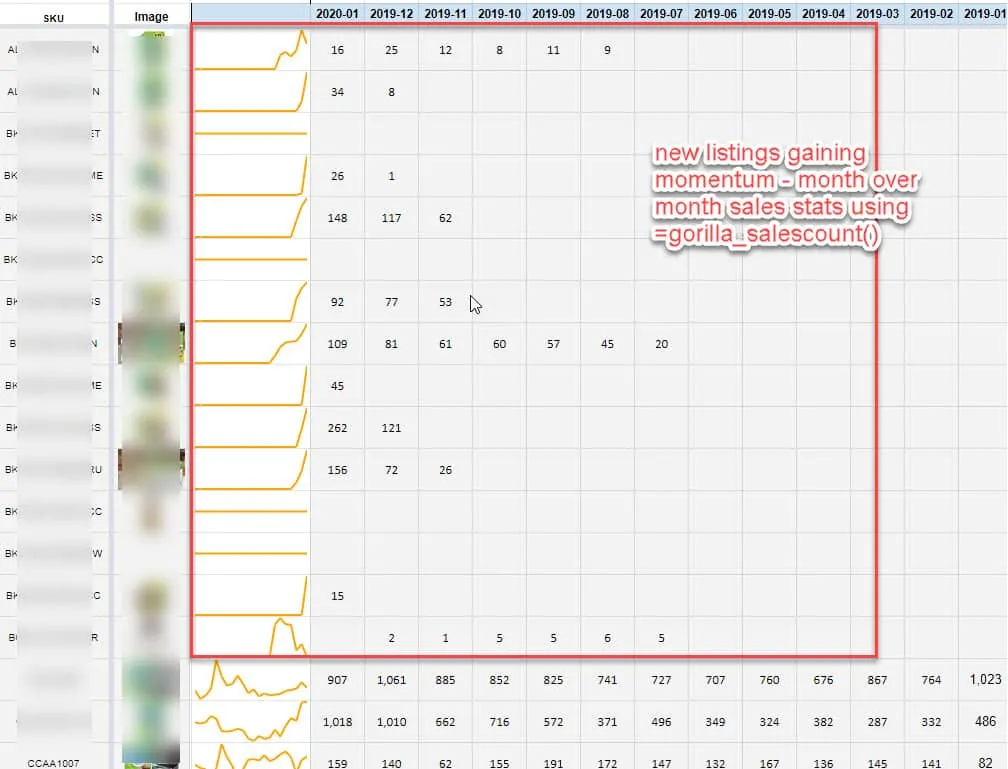

I would say the biggest contributor to the increase in revenue though are the new listings of variations and bundles we created throughout Oct and Nov.

I can instantly grab monthly sales stats per sku and then use Google Sheets sparkline feature to create small charts and show the monthly sales trend.

Side note: to get monthly data, enter the dates as YYYY-MM. Then use the format of the formula below for each month.

=GORILLA_SALESCOUNT("2020-01", "US", A4:A500, "all")

I’m looking forward to creating more listings and casting our net wider and farther to dominate the search results, sponsored ads areas and getting our listing to be synonymous with our target keywords.

Which brings me to…

Keyword Siloing

If you are familiar with SEO, siloing content and keywords is a polarizing topic. But in Amazon’s world, it works.

What is siloing?

By definition

Silo = isolate (one system, process, department, etc.) from others.

For listings, keywords and Amazon SEO, it’s allowing a listing to rank for a single purpose keyword.

I’m going to assume that most people (myself included) started out by creating product listings and threw in hundreds of keywords into the listing and backend keyword boxes. The intention was to try and get on the first page for all those keywords with the single listing.

More keywords = more traffic = more sales.

Right?

Wrong.

Since you are trying to win the Amazon’s choice award, there has to be correlation with the keywords your listing is targeting and what the shopper is searching.

You can only win one Amazon’s Choice badge at a time.

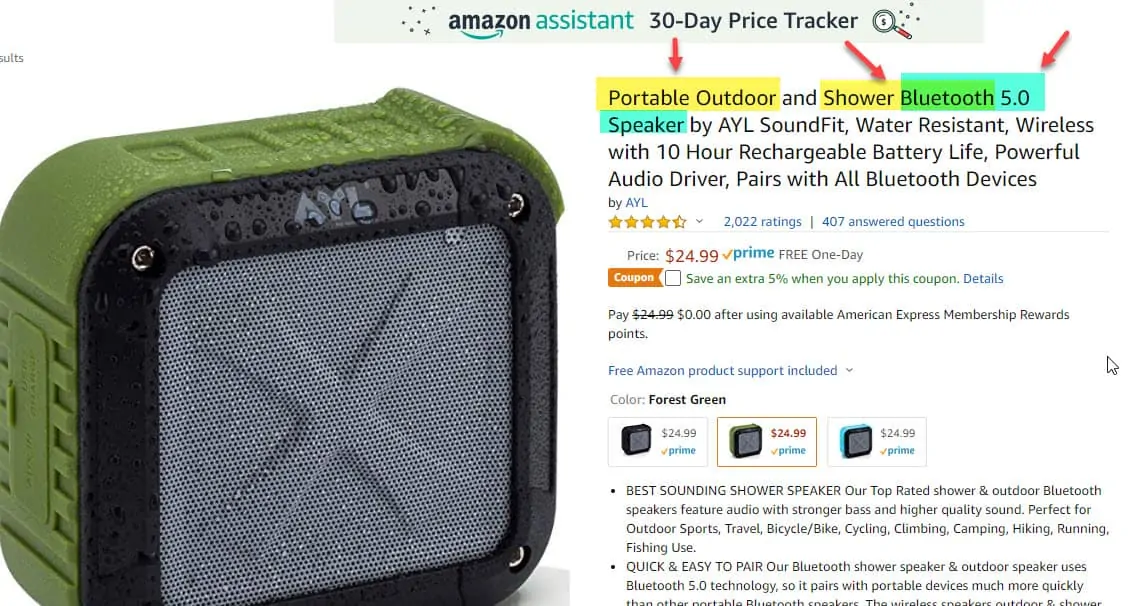

Here’s an example for “bluetooth speaker”.

This listing is going after keywords such as:

- portable outdoor speaker

- portable outdoor bluetooth speaker

- shower bluetooth speaker

- bluetooth speaker

The listing has 3 variations using the same title and information.

This is how we built most of our listings early on, and now as we try to improve them, it is a major pain. Since the title contain too many keywords, the listings that sold well cannibalized the other variations.

In the bluetooth speaker listing, they have 3 child variants.

They could have given a unique keyword to each of the color variants such as:

- Black = portable outdoor speaker

- Green = shower bluetooth speaker

- Blue = waterproof bluetooth speaker

This way, each variant has a specific objective and they aren’t stepping on each other’s toes.

Trying to fix this later when you have sales is going to be tougher because it could break the entire family of listings and sales will tank.

Try doing an assessment of your products to see what keyword it is converting for.

If the black speaker above is converting the highest for “portable outdoor speaker”, the entire listing should be updated to go all in on that keyword.

Other words will naturally be created in the copy, but you’ll be sending signals to Amazon and shoppers that the black speaker is THE product for “portable outdoor speaker”.

This is what we are doing for all of our younger listings. By siloing keywords and content we can make sure we aren’t overlapping and cannibalizing sales of what could be deemed similar.

Applying such changes to mature and strong listings is a different story and requires more precision and analysis. No need to fix what’s working well.

COVID19 and Impact to Sellers

If you do not source from China, what a huge relief.

For the rest of us, it’s trying to figure out the impact it will have. There are many people saying that this isn’t a big deal and downplaying what’s been going on.

I’m talking from business side here and not on the disaster itself.

I’ve found it helpful to be realistic and prepare for bad case scenarios versus being optimistic and being caught flat footed. That’s how businesses went out of business.

Blackberry and Samsung laughed at Apple when they first launched the iPhone. I know because I was part of the Samsung mobile division that launched phones for the US market from 2006-2014.

Blackberry is now dead in the water. Samsung scrambled and got back to #2.

You don’t have to go into full emergency mode, but factoring in 1-2 months of delays and rehearsing scenarios on how your team should handle and make decisions in these situations is a helpful and preventative measure. It’s also great training.

I would rather have an extra 1-2 months worth of inventory (overstock) of best sellers than be out 1-2 months of best sellers.

The coronovirus is going to impact:

- delays from raw material suppliers as they can’t make enough

- delays from manufacturers not being able to produce at full capacity

- delays because bigger companies may have placed massive orders and takes priority over yours

- delays as quality goes down because manufacturers are scrambling to manufacture and QA is a distant second

- delays because you have to find new or more inspectors

- delays as more paperwork from China is required for exporting and backlog of outgoing shipments at the port

- delays as manufacturers will play the force majeure hand and demanding an adjustment of the costs

Dismissing the impact of coronavirus means you are saying that none of the above are big risks and your supply chain is perfect.

It’s also a wake up call because China wasn’t a big deal for Amazon sellers in 2003 during SARS. In 2020, it’s safe to say that most US sellers rely too much or exclusively on Alibaba and Chinese suppliers.

Diversifying supply chains to different countries is never a bad idea. It’s a lot of work, but it can pay dividends later on.

For sellers who created their entire business based on Amazon+Alibaba, that’s a double whammy.

Even if you source 100% from USA or another country, you will have all your eggs in one basket. If a black swan event happens in America, the same issues apply. Having backup manufacturers to existing manufacturers is something we try to do in order to diversify the risk and once it is set up, it isn’t as hard to shift manufacturing from one place to another.

Again, it’s a lot of work. It’s like insurance. When you need it, you are super glad you have it.

Mismanagement of lead times… argh

In my December report, I was all proud that we didn’t run of stock for the Christmas rush.

Well, I spoke too soon.

Our sales have been spiking (good problem to have) but that means our inventory is running on fumes. A steady increase in sales is something we can project, but sudden 30-40% surges lasting for several weeks to a month means our buffer inventory is depleted.

To add to that, our containers were and is delayed at the port of departure, got held up in customs for exams and x-rays, and has been sitting idle for over a week.

Frustrating.

We’ve recalled other variant bundles from Amazon inventory that aren’t as important so that we can reallocate the product to more important listings.

This got me thinking about calculating lead times.

To date, we’ve used a simple method of the manufacturing lead time + 15 days.

No wonder I’ve gone out of stock so often. I realized that calculating the lead time is just like calculating the landed cost.

With landed costs, you have to factor into the pricing:

- cost to manufacturer

- packaging components

- handling charges

- duties

- taxes

- shipping

- and anything else that goes into making the product.

With leadtimes, I’ve only been thinking about:

- time to manufacture

- time it takes to arrive

When it should be broken into every detailed step.

- time from order submission to get raw materials

- time from start to end of production

- time for QA or send inspectors

- time to remake failed units

- time to pack and ship

- time at the port of departure

- time on the boat

- time at the port of arrival

- time of potential x-rays and exams

- time of delivery

- time to inspect

- time to repack

- time to ship to Amazon

- time to get to Amazon’s warehouse

My standard leadtime calculation turned out to be the best case scenario with no delay calculation.

In reality, it should have factored every single touch point for a realistic lead time.

Now that we’ve updated our lead times into our calculations, I’ll keep you updated on how it works out.

Financial performance benchmarks

I’m leaving the previous year’s numbers here because doing these numbers on a month to month basis doesn’t make sense.

There’s high fluctuations from one month to another. Easier and better to do it quarterly to see if we are hitting our objectives.

For this year, my goals are:

- COGS of 22% vs 23.3%

- Amazon fees of 40% vs 40.6%

- Gross profit of 34% vs 32.9%

- Amazon ad spend of 12% vs 12.4%

- Total operating expenses of 25% vs 25.5%

- Operating margin was 10% vs 7.3%

Wholesale and our online store

Wholesale is slower this month. January doesn’t have much going on as customers already stocked up during Christmas.

Found one customer who is now selling under our listing on Amazon.

That’s the problem if customers lie about selling on Amazon. Only thing to do is cut them off the wholesale list.

New automation and operational articles

More articles, tutorials and operational articles were posted.

- Zapier Amazon Seller Central integration review and alternative

- Amazon Review Checker with Google Sheets

- Free Amazon FBA Spreadsheet Template and Sales Analysis Tools for Google Sheets and Excel – UPDATED

- 2020 Amazon seller fees guide. Examples and free spreadsheet.

- Best software for FBA sellers and how we use it in our FBA business – UPDATED

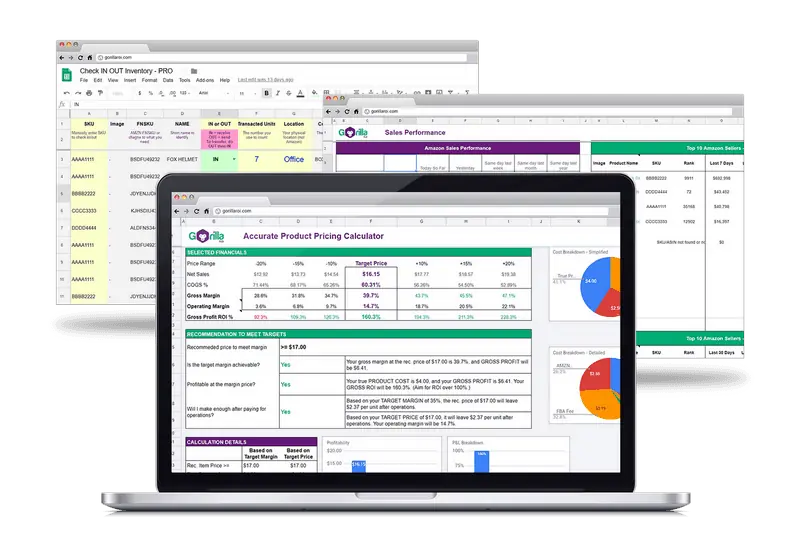

Free FBA spreadsheets for all

If you have messy sheets and need something refined to help run your numbers, get the free Amazon spreadsheets.

You can download it immediately without having to sign up for anything.

Just copy straight to your account.

If you want to get updated data straight into your own Google sheets, you can use Gorilla ROI. It makes work so easy when you don’t have to manually update data or log into accounts constantly and wasting time.

Comments

Related Posts

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

Leave a Reply