Here’s the current Gorilla ROI Amazon sales progress. To see the interactive version, go to our income reports page.

Note: These monthly updates are for educational purposes only.

Article Summary (TL;DR)

✅ Explore the performance metrics and milestones achieved in March & April for our FBA business.

✅ Gain insights into the challenges faced and lessons learned during the month, highlighting opportunities for improvement and future growth.

✅ Learn about the strategies implemented to drive sales growth, including inventory management, pricing optimization, and marketing efforts.

A tough couple of months and more to come.

If you spend enough time on Facebook or YouTube, Amazon is supposed to lead to Lamborghini’s, penthouses and riches. Amazon automation they say…

My March and April reveal the true grind and pain involved with running an Amazon business.

- March and April summary

- Amazon taking down listings

- #1 seller wiped out. #2 seller classified as hazmat.

- Inflation and supply chain concerns

- NEW Gorilla ROI functions and templates

First, the numbers as usual.

March stats

- $338k in sales.

- Up vs last year.

- Down vs last month.

- 4% up from the same month last year

- -21% down from the previous month

- Conversion rate decreased to 33.2% vs 35% last month

- ACoS decreased to 25.9%.

- TACoS decreased to 10.2%.

- Mar Sales to Inventory ratio decreased to 1.88 (higher is better)

- Last month Sales to Inventory ratio was 2.24

March shows big downtrends across the board. April is worse.

April stats

- $264k in sales.

- Down vs last year.

- Down vs last month.

- -55.8% down from the same month last year

- -22% down from the previous month

- Conversion rate decreased to 31% vs 33.2% last month

- ACoS decreased to 24.7%.

- TACoS decreased to 9%.

- Apr Sales to Inventory ratio decreased to 1.02 (higher is better)

- Last month Sales to Inventory ratio was 1.88

We are doing the direct inverse of last year and May is looking bleak too.

The only green aspect is the reduction in PPC as we cut bids, stopped campaigns, and paused others. Anytime I see TACoS below 10%, I’m a happy camper. Regardless of how slow our sales have turned, PPC is always the single biggest spend. I am never going to complain with more efficient ad spend.

To best understand the picture of what’s happening there are a few major culprits.

- Our number 1 best seller is still delisted. I’ve pretty much given up on this one.

- Our number 2 best seller got converted to a hazmat product.

- Rationing inventory so as not to go completely out of stock.

Amazon Performance Fools

This update has a lot of rants. And you’ll likely agree with most of them.

I shared in the Feb update how our #1 best-selling item got hit with a used as new complaint.

This listing has over 3000 reviews, rated 4.6/5, one used as new complaint out of hundreds of thousands of sales.

In order to get things back up and on track, we ended up dissecting everything and revamped everything from top to bottom for the inbound, QA, packaging, and outbound process of this product.

I shared a basic version of a Plan of Action reinstatement letter and since then I’ve written more than 10 new versions addressing everything Amazon was asking for.

Any new POA submissions are shot down within an hour.

My team manager has been on the phone incessantly with Amazon trying to get through to someone. Totally useless.

You’ll have more luck training a monkey to navigate seller central than getting someone from Amazon who can help.

The Amazon performance team being sheltered like they are an elite squad holding all the power is a damn joke.

The way I see it, it creates a lack of accountability on their part. For all I know, they could be hiring interns or offshore cheap labor who suddenly have the power to bend or break any ASIN or company they see fit.

After all, if your incentives and your job performance are based on how many “bad” listings you’ve taken down for safety reasons, what do you think the go-to solution will be?

It’s easier to delete and reject requests rather than go through the hassle of looking into the issue. Why bother reinstate listings?

Number 2 best seller converted to hazmat

To make matters worse, in March, our number 2 seller (which became our new best seller) was suddenly classified as hazmat out of the blue.

The SDS clearly show that it’s not hazmat, however, SDS submissions are rejected without reason.

I guess the OSHA standard SDS just isn’t good enough for Amazon. Another supposedly “professional” department where an internal team reviews it. Now that I’ve seen firsthand how everything unfolded, I’m not surprised that the people who review SDS documents have no clue what they are doing.

With all the rejections we were getting, my supplier and I started tracking the tiny changes we were making to the SDS. I’m confident that a low-level employee at Amazon, reviews sections 1, 2, and 14 of an SDS and will flag a product as hazmat based on what they have been trained to look for.

Completely ignoring what the actual product ingredients, classifications, and ratings say.

The final change we made that got the SDS approved was changing the supplier name on the SDS to the brand it was being sold under.

If your SDS is not being accepted, make sure the “supplier name” is updated to show the brand name. That’s how ridiculous it is.

Each SDS review takes 4 days. With about 5 submissions, and excluding weekends, a month was wasted.

During this time, Amazon pulled all the inventory and transferred it to their hazmat FC. This took down the product availability for a good month.

With it no longer classified as hazmat, Amazon now does the reverse where they pull it from the hazmat warehouse and distributes it across the country again.

By the time the product is able to be in stock again, it’s 6-8 weeks down the drain.

If you sell anything that requires an SDS, I would have it updated to include your brand name asap. That way, if something gets yanked, you can submit it immediately.

Our proactive approach was to reupload the SDS for every listing. That way, we can make sure it’s out of the spotlight and be proactive rather than wait until Amazon flags it and then hustle to get the docs ready.

Rationing inventory and inflation

The general consensus is that it’s going to take another 2 years for freight to get better.

I’m not surprised and the timeline sounds about right.

- 1-2 months to get a confirmed container booking from overseas

- Supplier lead times extended by 30 days

- Premium booking prices being applied to shipments whether you like it or not

- Trucking costs still sharply increasing

- Raw materials pricing increasing at warp speed

Despite ordering way in advance, it doesn’t seem to matter nowadays because even the supplier is waiting to get their raw materials.

Just like what car manufacturers are doing. With the chip shortage, manufacturers are rationing and allocating the chips towards their best-selling high-margin vehicles.

We were left trying to ration our inventory towards the highest margin SKUs.

Rather than selling a product individually with lower margins, we’re resorting to letting the individual listings go out of stock, or increasing the price to slow down sales, or assigning the inventory towards a higher margin bundle.

Thankfully, we are getting close to having our inventory back in stock. The sad reality is having to go from ordering 4-5 months’ worth of inventory to a minimum of 8 months of inventory.

Frequent shipments of lower quantity aren’t going to work for the next 2-3 years. Hope you have a strong balance sheet and cash flow to factor all this in.

To account for all the extra inventory we have to order, our 4000 sq ft warehouse is maxed out and I’m close to signing another 4500 sq ft warehouse nearby.

Not ideal, but looking at the trend and how things are heading, space is going to be another precious commodity.

The fed is downplaying inflation. However, when you see lumber prices up 200+%, paper prices up 50+%, stainless steel up 50+%, copper up 50%, tin up 50%, shortage of chips, freight costs up 200-300%, don’t tell me there’s no risk of inflation or it’s temporary due to pent up covid demand.

We know that the consumer is going to get screwed big time. The common consumer is being boiled slowly so they don’t feel the sharp pain.

Our costs have gone up, demand is high, supply is low, more printed money in people’s pocket they want to spend.

Yup. Inflation.

- Recalculate your lead times and analyze every component of it

- Reevaluate your costs because raw materials are going up for everything

- Reevaluate your selling price weekly

- Check your COGS spreadsheets weekly

I wrote a very detailed and lengthy post on Amazon supply chain management and the current outlook.

Amazon lawsuits will lead to more red-flagged listings

Don’t know if you have noticed but the past month has seen a glut of listings from all sellers being either misclassified or yanked.

A listing for a pair of glasses is now yanked because it doesn’t have an EPA number associated with it.

Your listing content that was fine for 10 years, will now be delisted as PCRP (Personal Care Restricted Product) for having a word like “liquid” or something as basic as “grime”.

I believe this sweeping change will become more aggressive as Amazon inches closer to potentially losing lawsuits from consumers over product safety. Until now, Amazon has shifted the blame to the 3rd party sellers, but more attention is being placed on Amazon as the one to take the fall.

Good.

However, it also means we have to think ahead of how things could impact us.

Real product testing reports, claims reports, safety documents, claims on listings, documents, more algorithmic deletions, images and so on.

However, I believe it “theoretically” will make it better over the long run to weed out the bad actors. But I’m sure Amazon will try to implement changes via software and algorithms, which means more operational headaches dealing with Amazon.

Enough crapping on Amazon this month. I have to leave some for next month 🙂

NEW Reimbursements Gorilla feature

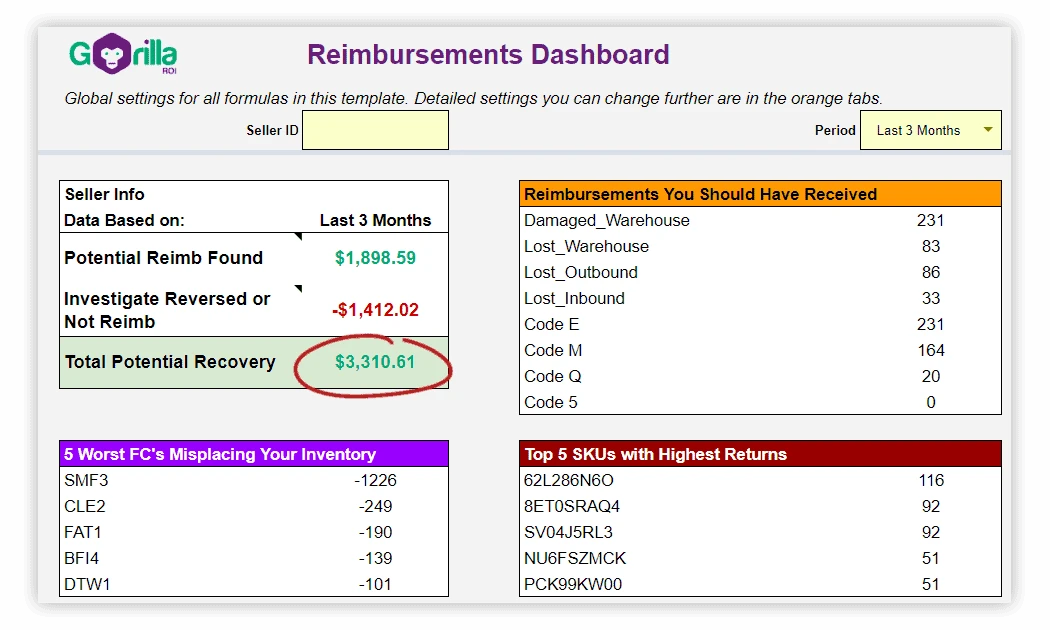

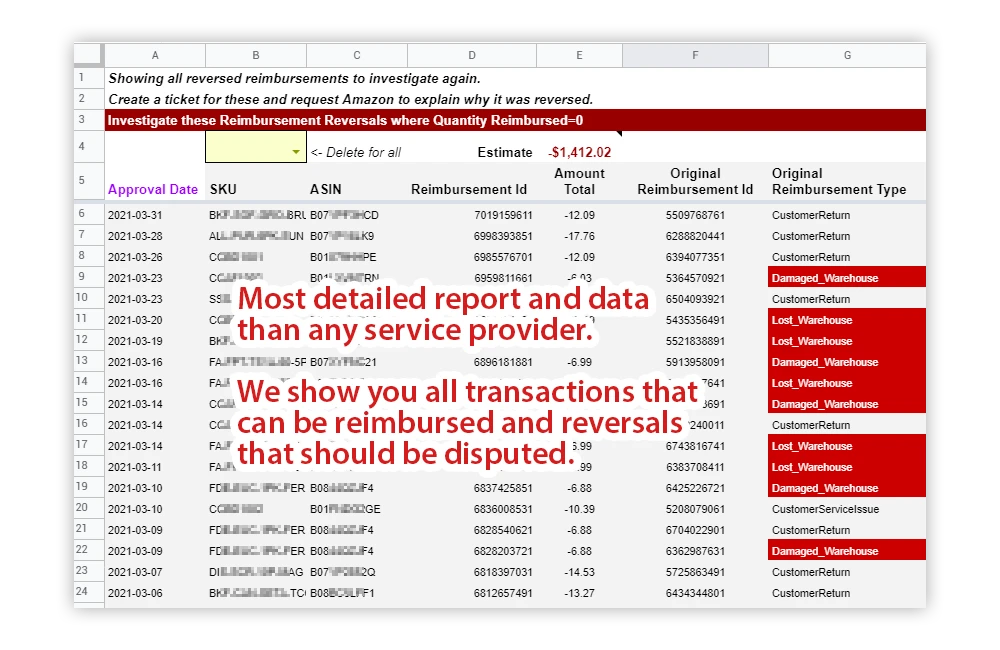

The big new addition that we recently finished is our Amazon Reimbursement plan.

Manually trying to figure out reimbursements is complex and tedious.

There are many good agencies and service providers who do this, but you end up paying a percentage of your profits to them.

Our reimbursement plan is an addon subscription to your current subscription plan.

This is the reimbursement spreadsheet preview link.

A couple of screenshots of the spreadsheet.

With the Reimbursement add-on, you will be able to get the following new reports:

- Reimbursement report

- Inventory adjustments report

- Returns report

- Shipments report

By combining all of these reports and with the help of the reimbursement spreadsheet, you can request reimbursement for lost and damaged items, incorrect returns, see which FC’s are misplacing your items, incorrect sizing fees and more.

Learn more about the Amazon Reimbursement plan. You can add it from your account directly.

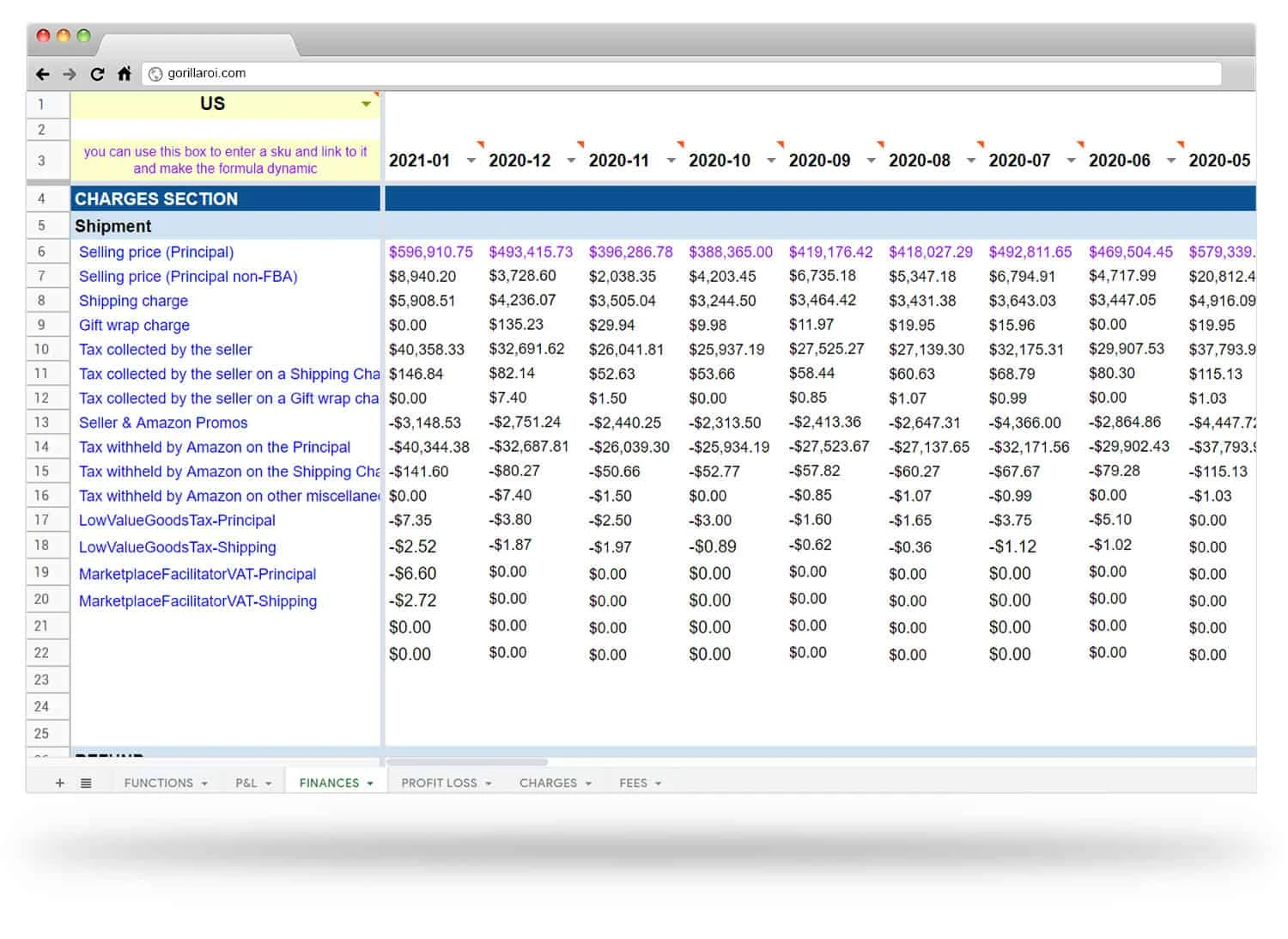

NEW spreadsheets and updates

We’ve completely remade some existing spreadsheets and added new ones for PRO package users.

[PRO USERS] SKU Level Sales and P&L

If you want to look at your sales and Amazon Profit Loss on a per SKU level, this is for you.

- Shows monthly sales by SKU

- Per SKU level P&L for a single time period

Only available for PRO Business Package Subs. Download from your account.

[PRO USERS] NEW Profit Loss with COGS calculation spreadsheet

This is a complete new version of the Profit Loss spreadsheet. This now auto-calculates your COGS. Enter your COGS data into the tab “ProdData” and for each month, it will calculate your total COGS based on the number of units sold.

No more providing software providers your sensitive COGS data. Keep it 100% internal.

Only available for PRO Business Package Subs. Download from your account.

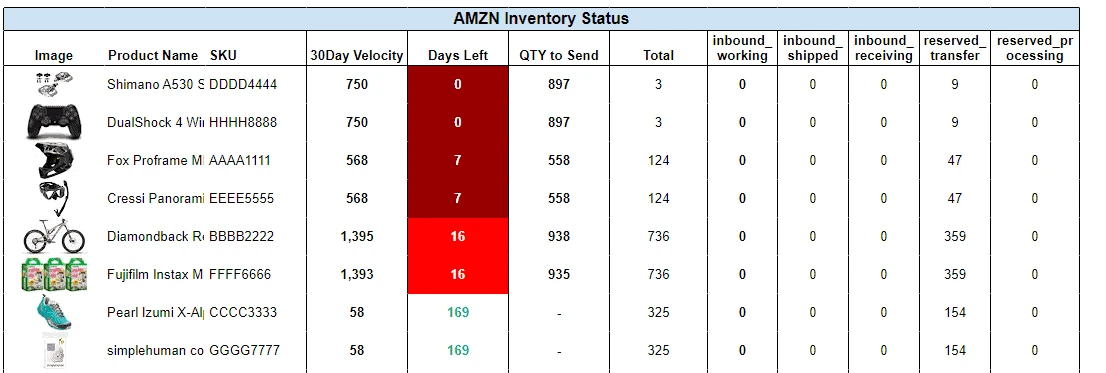

UPDATED Inventory management spreadsheet

One of the top most downloaded spreadsheet is the Amazon inventory management spreadsheet.

Download this new version which includes all the different Amazon shipping stages. Keep track of it all by SKU from a single location.

Download it from your account at app.gorillaroi.com

Comments

Related Posts

The ultimate guide to Shopify marketing attribution: what works best for your business?

What you’ll learn Have you ever wondered where your customers…

Top 5 Strategies to Sustainable Shopify Growth: Turning One-Time Buyers into Lifetime Customers

What you’ll learn As a Shopify seller, you’re constantly looking…

Mastering Shopify’s UTMs: The Simple Way to Smarter Marketing

Let’s be honest: marketing your Shopify store without tracking what’s…

Leave a Reply