Here’s the current Gorilla ROI Amazon sales progress. To see the interactive version, go to our income reports page.

Note: These monthly updates are for educational purposes only.

Article Summary (TL;DR)

✅ Explore the performance metrics and milestones achieved in September for our FBA business, reaching $250K in sales.

✅ Gain insights into the challenges faced and lessons learned during the month, highlighting opportunities for improvement and future growth.

✅ Learn about the strategies implemented to drive sales growth, including inventory management, pricing optimization, and marketing efforts.

September is in the books. I’ll break down what’s been going on with our Amazon business and what I’m seeing on the horizon.

First, the numbers as usual.

September stats

- $250k in sales.

- Down vs last year.

- Same vs last month.

- -40% down from the same month last year

- 0% no change from the previous month

- Conversion rate increased to 33.4% vs 31.7% the previous month

- Session value increased to $5.76 (sales ÷ sessions) vs $5.27 last month

- ACoS decreased to 31.3%.

- TACoS decreased to 16.6%.

Short version: Trending in the right direction.

The important stats are moving in the right direction. After a very rough July, the ship has righted itself operationally.

Here’s a no-growth scenario I’ve entered into the free Amazon revenue calculator and forecaster.

These are the numbers from September.

With 0% growth entered, this is a scenario of what it would look like if everything stayed the way it is. It’s a good way to see where you are now and consider how it will turn out if you grow faster or slow down.

The point of the free revenue tool isn’t to plug in your stats and then end with a “nice job”. Its purpose is to force you to ask pointed questions.

- Why is the operating margin at 13.4%?

- What can we do to lower ACOS but maintain sales?

- Which lever has the biggest impact on my business?

- What is creating a lot of effort with minimal ROI?

- What can we do to increase the average order value to $17?

If you are looking at massive rows on a spreadsheet, it’s hard to know what questions to ask. There’s too much noise.

Having a zoomed-out picture will help you come up with questions that actually matter.

For us, losing our best seller shows how important it is to diversify by offering different sizes or colors, or bundles. We still haven’t been able to recoup the majority of it as we have also been affected with supply issues as my manufacturers are slammed with their own slow delivery issues, order backlog, and shipping issues.

A big frustration point I’ve been having the past five-ish months is feeling like Amazon’s algorithm is being tweaked too often.

Not sure if it’s the PPC algo, or SEO side, but we have SKUs that start to take off, and then the minute we send in a big shipment to cover the velocity, it’s like Amazon automatically presses the brake and slows the sales down from 30 a day down to 5 or 6.

No changes in the listing, no changes in PPC. Nothing other than sending inventory in.

Have you experienced anything like this?

However, conversions are going up and are higher than usual around this time. Precovid, my conversions were in the mid to upper 20% range, but ever since covid, conversion has jumped to consistently being in the 30% range.

Expecting December to be a very high converting month which means that prices could be increased further to offset the demand and likely lack of products.

Last month, I also talked about a new product we received, but by the time we received it, the freight cost ended up being $15k which completely upended our expected cost and pricing analysis.

We finally got it stacked in a way to maximize pallet space, and sent it off to Amazon with the goal of breaking even.

It’s our first $40 product as we look to get into higher-priced products. It’s also why you see the session value go from $5.27 to $5.76.

We’ve raised our prices to offset other increases as well. Also, we don’t want to be seen as a cheap product relative to the competition.

Although our products are priced for profitability, anchoring bias from shoppers means that they are viewing our products as inferior because it’s slightly cheaper than the competition.

Something to test out if you see competitors marking up prices.

Like our content? Follow our journey to reach $10M in sales

We share our real failures, wins, and what we are doing on our journey from $0 to $10M in sales.

Heading into Q4

With one more quarter to go this year, I haven’t reported in terms of what’s been working or having big good surprises this year.

If you look back through my previous year’s Amazon income reports, it’s mostly been solving problems and maneuvering around what seems to be an endless stream of obstacles.

It comes with any business, but more so with Amazon.

I see it as part of Amazon’s new CEO as he tries to make his footprint and takeover Bezos’ shadow. That’s why I think there have been so many releases and developments on the marketplace side.

So far this year, the devs have gone crazy with pumping out as many changes as possible. All the new UI changes, different features with PPC, brands, shipping templates, analytics, reports, insurance requirements, charts, APIs, terms of service, and more.

But overall, no need to feel bad for us as it’s part of business and we enjoy solving the problems.

The results aren’t showing in terms of huge growth in sales and profitability, but I know that we are laying the right foundations to help us in the near future.

As we get into the slower months just before end-of-year shopping hits, I wonder how the current landscape of container issues and rising costs will affect the consumer. Fear-mongering is already being pushed by mainstream media.

- Does this mean that we are 3 months already too late with our orders?

- How big is the receiving backlog at Amazon?

- What’s the lead time with getting a container booked now?

- How will cash flow be affected by buying inventory 8-10 months in advance?

- What can be done if Amazon starts to impose ASIN limits again?

Brain scratching but real questions that will come up in Q4.

But going into Q4, we know that

- costs will stay high

- Amazon will stay slow

- more competition from sellers

- the quality level of listings has shot up

- PPC will be expensive and more brutal

- going out of stock will be a killer

The only thing that I can think of that will counter most of this is to raise prices accordingly. New products that I was excited for that we have had in the pipeline won’t make it this year.

Huge disappointment as we miss Q4 sales opportunity perfect time to launch a product. Now, our goal is to remain in stock, monitor inventory supply and prices like a hawk.

Prepping in advance for best results

I’ve got my inventory spreadsheet set up and another column to track prices and buy box status. Helps the team keep a hawk-eye on things and make quick decisions.

If you have the inventory management template, you can easily add prices, buy box status, or anything else to make it robust. Prepping it now rather than later is going to make your life easier.

For ours, I’ve added package dimensions because Amazon has been incorrectly measuring our packages.

This way, my team is made aware of any incorrect fees that would change profitability. Saved us so much time and money to see it all in one go.

Utilization is back again?

Amazon has brought back the utilization data. For markets outside of the US, it is applied to an ASIN level. I don’t think Amazon will apply it to the ASIN level again for the US market as they saw how much of a mess it was last year.

But who knows with Amazon.

In any case, it’s not a bad time to revisit your Q4 prep, make sure you have all the tools, KPIs, and data lined up so that when the shopping season begins, you won’t be trying to juggle everything at once.

NEW Gorilla features

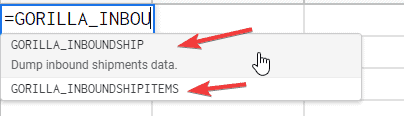

Two new functions have been created. Docs and videos haven’t been posted yet, but it’s very easy to use. Literally doesn’t need any inputs to start with.

GORILLA_INBOUNDSHIP(shipmentid, status, count)

EXAMPLE

- GORILLA_INBOUNDSHIP()

- GORILLA_INBOUNDSHIP("FBA12XYZ34", "All", 50)

ABOUT

Dump inbound shipments data.

GORILLA_INBOUNDSHIPITEMS(filter, shipmentid, received, count)

EXAMPLE

- GORILLA_INBOUNDSHIPITEMS()

- GORILLA_INBOUNDSHIPITEMS("SKU12345", "FBA12XYZ34", "All", 50)

ABOUT

Dump inbound shipment items data.

GORILLA_INVENTORYRESTOCK has been updated to include the additional columns that Amazon added to the reports.

Questions for you

To finish off, I have some questions for you. Leave your answer in the comments. I read them all.

- What do you think about the new format of showing the stats via the revenue forecaster tool?

- What type of content do you want to see more of?

- What is a theme you expect to play out in Q4?

Comments

Related Posts

10 Profitable Product Categories for Amazon Affiliates 2025

What you’ll learn Amazon is a favorite for experienced and…

Unlock the Secret to a Profitable Automated Amazon Store: How to Build a Hands-Free Income Stream

Ever dreamed of running a profitable Amazon business while sipping…

Master Amazon New Restricted Keywords: A Seller’s Guide to Success

Changes to Amazon’s restricted keywords list have taken a lot…

Leave a Reply